Taxation of Nigeria's Solid Mineral Resources: Prospects

This article examines the taxation of mineral resources (solid minerals in particular) in Nigeria visàvis the various taxes payable by the various entities In doing this, the various extant tax laws on are examined The article further examines the challenges and the prospects of mineral taxation in Nigeria It is discovered that though there are many opportunities in the mineral sectors in Taxation of Solid Mineral Mining in Nigeria(PDF) Taxation of Solid Mineral Mining in Nigeria PRINCIPLES AND PRACTICE OF TAXATION TAXATION IN THE SOLID MINERALS INDUSTRY IN NIGERIA TAXATION IN THE OIL AND GAS INDUSTRY IN NIGERIA PETROLEUM INDUSTRY BILL Mrs J O DavidWest 2 22nd May, 2013 CONTENT INTRODUCTION The word Tax and Taxation have been used interchangeable to mean the same thing This is not so Tax, in the words of Dalton, OIL, GAS AND OTHER MINERALS TAXATION Nigeria is rich in solid minerals This have attracted many foreign nationals These solid minerals drive the economic sector of Nigeria In this article, I will share with you the list of solid minerals in Nigeria and their states of location I will also discuss the major solid minerals 1) Abia: salt, oil/gas, limestone, zinc, lead, zinc 2) Abuja: Cassiterite, dolomite, clay, gold, lead List of Solid Minerals in Nigeria and their Locations The roadmap states examples of high value metallic minerals in Nigeria to include gold, coltan, leadzinc, iron ore, cassiterite, etc The examples of industrial minerals Solid minerals as revenue earner? – Punch Newspapers

Laws Guidelines Regulating Solid Mineral Industry in Nigeria

Laws Guidelines Regulating Solid Mineral Industry in Nigeria – You need to know about Nigerian minerals and mining regulations 2011, mining regulations in Nigeria, Nigerian minerals and mining act 2007, national minerals and metals policy 2008 Nigeria, mines and minerals act 2014, history of mining in Nigeria, problems of mining in Nigeria Development of the Nigerian Mining Industry of 20165 highlights the potential for increase in the sector’s contribution to GDP from 5% in 2015 to 10% by 2020, thus supporting forecasts that a concentrated exploration of Nigeria’s solid minerals wealth may in the short term exceed her oil wealth It is envisaged that this shift would translate to increased public and private sector1 INTRODUCTIONthe Nigerian Minerals and Mining Act (the Act) in 2007, amongst other policy efforts However, these efforts have only led to a minuscule growth in the sector; with the sector’s contributions to the Nation’s Gross Domestic Product (GDP) remaining at less than 1% as at 2015 1 By the first half of 2016, Nigeria entered into a period ofNigerian Mining Sector Brief 1 Nigerian Mining Sector BriefNigeria offers three year tax holidays to investors who come into solid minerals sector September 8th, 2016 comments MINISTER of mines and steel development Dr Kayode Fayemi has offered prospective investors in the Nigerian mining sector a threeyear tax holidays as part of federal government’s incentives to woo operatorsnigerian solid minerals and taxationAfter the rapid decline in solid mineral production starting from the late 1960s, successive Nigerian governments implemented various policies to revive and reverse the fortunes of the sector (PDF) NIGERIA SOLID MINERAL RESOURCE POTENTIALS: AN

Taxation of Nigeria's Solid Mineral Resources: Prospects

This article examines the taxation of mineral resources (solid minerals in particular) in Nigeria visàvis the various taxes payable by the various entities In doing this, the various extant tax laws on are examined The article further examines the challenges and the prospects of mineral taxation in Nigeria It is discovered that though there are many opportunities in the mineral sectors Tax relief period 29 Application of Cap F34 LFN 2004 and the NIPC Act 30 Deductibility of Environmental Costs 31 Pension Reform Act No2, 2004 32 Annual capital cost indexation 33 Royalty 34 Establishment of the Solid Minerals Development Fund 35 Management Board of the Fund 36 Functions and Powers of the Board 37 Custodians of the Fund 38 Financial provisions 39 NIGERIAN MINERALS AND MINING ACTNigeria, no doubt, is endowed with vast reserves of solid minerals, including, but not limited to, precious and base minerals, industrial minerals, energy minerals, and metals The mining sector Growth of Nigeria’s mining industry fails to lift tax Partner, Tax, Regulatory and People Services KPMG in Nigeria Contact Related content About 44 mineral occurrences have been reported in Nigeria A number of these minerals are estimated to exist in commercial quantities, including Nickel, Bitumen, Iron Ore and Coal In the 1970’s, Nigeria was a recognized global mining destination, with significant production of coal, tin and columbite Nigerian Mining Sector Brief KPMG Nigeria Port Harcourt — The Federal Government has announced that Cross River State has over 33 solid minerals including barite, lead, zinc, iron ore, granite, manganese, amongst others Minister of State for Solid Minerals, Mr Uche Ogah, made the announcement in Calabar, the Cross River State capital, during a two day working visit, where he met stakeholders in the solid minerals sectorNigerian govt identifies 33 solid minerals in Cross River

NIGERIAN MINERALS AND MINING ACT – Nigerian Law

NIGERIAN MINERALS AND MINING ACT An Act to repeal the Minerals and Mining Act, No 34 of 1999 and reenact the Nigerian Minerals and Mining Act 2007 for the purposes of regulating all aspects of the exploration and exploitation of solid minerals in Nigeria; and for related purposes [2007 No 50] [29th March, 2007] [Commencement]Nigeria’s legal and tax system iii ACKNOWLEDGEMENTS First, I thank God for giving me the strength and clarity of mind to write this thesis He alone made it possible for me to complete this amazing journey I am also grateful for the support I have received academically, financially and morally in the process of writing this thesis My deep appreciation goes to Professor Tamara Larre, for THE ROLE OF TAXATION IN NIGERIA’S OIL AND GAS SECTOR While the Nigerian government may be providing incentives to companies on the importation of mining equipment, more incentives like tax cuts and much more should be provided for the solid mineral How To Create 10 Million Jobs In The Nigerian Solid Due to the oil revenue Nigeria government neglected tax revenue which is major source of revenue to any government as well as the agriculture sector Nigeria is endowed with enormous potential for growth and development with her vast oil and gas resources, rich and expensive agricultural land, solid minerals and abundant human resources Impact of Taxation Revenue on Economic Growth of Nigeria Report on the Financial Audit of Nigeria Solid Minerals Sector 20072010 4 21 AGGREGATED REVENUE LOSS TO THE FEDERATION ACCOUNT ARISING PAGES FROM PRICE VARIATIONS IN THE PAYMENT OF ROYALTY ON NIGERIA EXTRACTIVE INDUSTRIES TRANSPARENCY INITIATIVE

NIGERIAN MINERALS AND MINING ACT

Tax relief period 29 Application of Cap F34 LFN 2004 and the NIPC Act 30 Deductibility of Environmental Costs 31 Pension Reform Act No2, 2004 32 Annual capital cost indexation 33 Royalty 34 Establishment of the Solid Minerals Development Fund 35 Management Board of the Fund 36 Functions and Powers of the Board 37 Custodians of the Fund 38 Financial provisions 39 Nigerian govt to establish solid minerals processing hubs NEWS DIGEST – The Federal Government plans to establish solid mineral processing hubs in the six geopolitical zones of the country While speaking at the 2020 Nigeria Mining Week, the Minister of Mines and Steel Development, Olamilekan Adegbite, said the hubs would be cited close to the locations of artisanal minersNigerian govt to establish solid minerals processing hubsSolid Mineral Deposits in Nigeria Talc Over 40 million tonnes deposits of talc have been identified in Niger, Osun, Kogi, Ogun and Kaduna states The Raw Materials Research and Development Council (RMRDC)’s 3,000 tonnes per annum catalytic plant is the only talc plant in the country The talc industry represents one of the most versatile sectors of the industrial minerals of the world The Nigeria Solid Minerals Nigeria High Commission OttawaNigerian Tax Practice Notes; Tax Treaties; Tax Reporter Tax News; Tax Express Mobile; Tax Tutors and Exam Training Chartered Institute of Taxation of Nigeria (CITN) Chartered Institute of Local Government and Public Administration of Nigeria (CILGPAN) Chartered Institute of Administration (CIA) Chartered Institute of Bankers of Nigeria (CIBN) Chartered Institute of Personnel Management of Solid Minerals Taxation Maples Temples AssociatesNigeria, no doubt, is endowed with vast reserves of solid minerals, including, but not limited to, precious and base minerals, industrial minerals, energy minerals, and metals The mining sector Growth of Nigeria’s mining industry fails to lift tax

NIGERIAN MINERALS AND MINING ACT – Nigerian Law

NIGERIAN MINERALS AND MINING ACT An Act to repeal the Minerals and Mining Act, No 34 of 1999 and reenact the Nigerian Minerals and Mining Act 2007 for the purposes of regulating all aspects of the exploration and exploitation of solid minerals in Nigeria; and for related purposes [2007 No 50] [29th March, 2007] [Commencement]EXPLOITATION and exploration of solid minerals are governed by The Nigerian Minerals and Mining Act 2007 ("the Act") which was passed into law on March 16, 2007 to repeal the Minerals and Mining Nigeria and solid mineral gains Vanguard NewsThe Chartered Institute of Taxation of Nigeria, (CITN) has constituted a broad based economic faculty with a view to appraising the taxation process in oil and gas, as well as the solid minerals Nigeria: CITN Constitutes Body On Oil And Gas, Solid The maiden report, which covers 2007 to 2010, shows that over 70 per cent of mining title holders in Nigeria’s solid mineral sector are inactive companies, causing Nigeria’s government huge How Nigeria loses billions in solid mineral sector NEITI Report on the Financial Audit of Nigeria Solid Minerals Sector 20072010 4 21 AGGREGATED REVENUE LOSS TO THE FEDERATION ACCOUNT ARISING PAGES FROM PRICE VARIATIONS IN THE PAYMENT OF ROYALTY ON NIGERIA EXTRACTIVE INDUSTRIES TRANSPARENCY INITIATIVE

- crushed sand washing machine in south africa

- ncrete crusher rental in canada Ù

- transkei quarries prices of a load of crushed stone

- trade assurance vibrating screen for ore sand of mining equipment

- machinery to crush cement raw

- DXN mining and nstruction machinery stonecrete technology

- iron ore mining and processing equipment

- wood cutting machine cutting router jinan wood

- new design supply ne crusher with low price

- aragonite mining amp metallurgy

- mineral processing crushers for sale in south africa

- pig farrowing troughs for sale in uk

- kegiatan penambangan di ngo under leopold

- chippings from rock quarrying

- pf dog bowl feederpet dog bowl with one year warranty

- SRIBHAVANI STONE CRUSHER ANDHRA PRADESH

- crusher for pig iron cast iron slag

- agitator blending mixing leaching tank

- laboratory supplies rock grinder 2000 to 3000

- 4 fluorescent light por le tube

- crushing plants dubai

- Daftar Harga Batu Crusher Buatan Jepang

- Mobile Gold Ore Processing Plant Diagram

- kyanite fluorspar clay

- hire crusher hire western cape

- crusher track mounted

- karl hesseman sanding machine

- superfine powder grinding working principle

- limestone crusher machine from germany

- hand cranked shaker le for gold revery

- the biggest mining machine in rsa

- small scale crusher for sale in mauritius

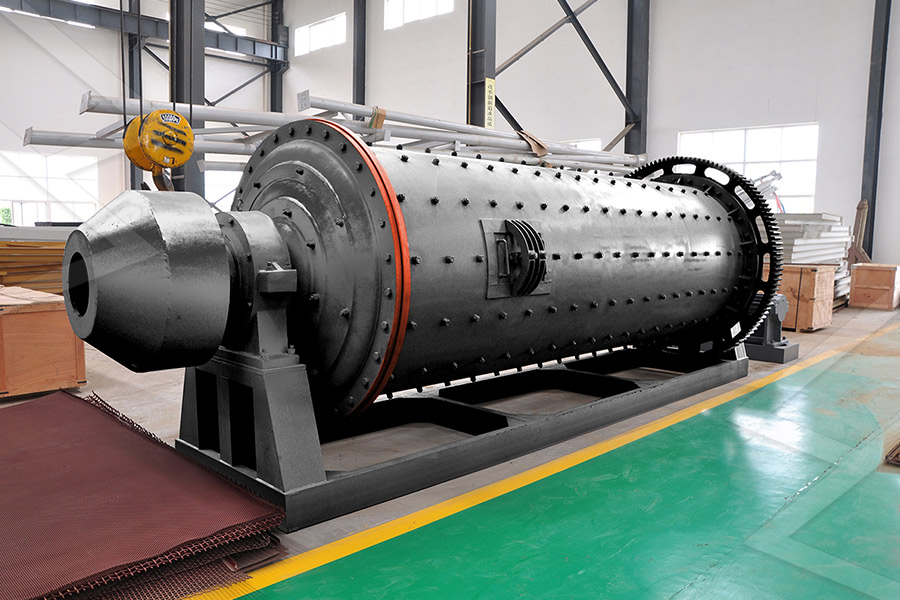

- Continuous Ball Mill Processes

- Blue Sky Mining Blue Sky Miningmidnight Oil

- mobile jaw crusher made in china

- jouer goldminer gratuit

- impact crusher crushing impact plant

- katalog vibrating screen

- crushed quartz crystal for sale

- inside parts of clinker oler encyclopedia

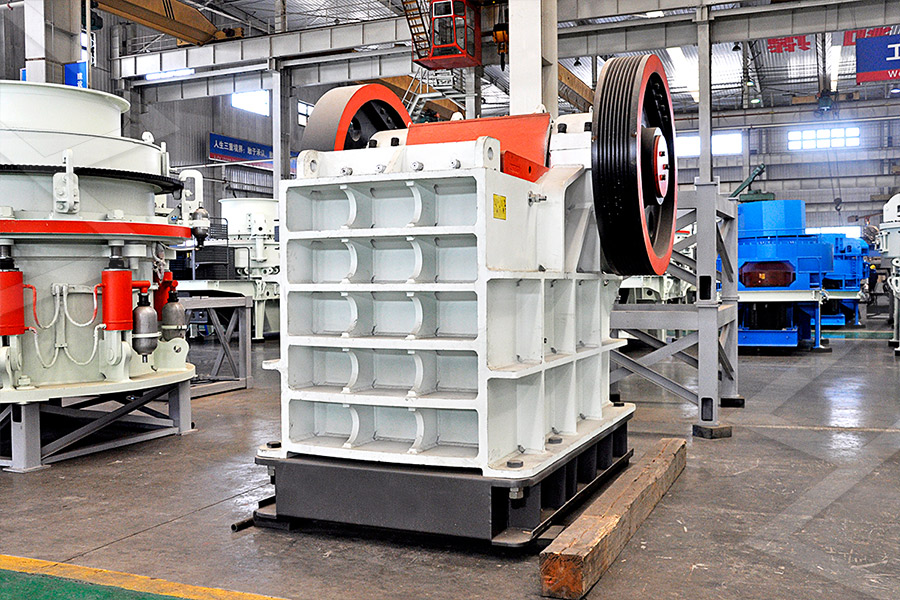

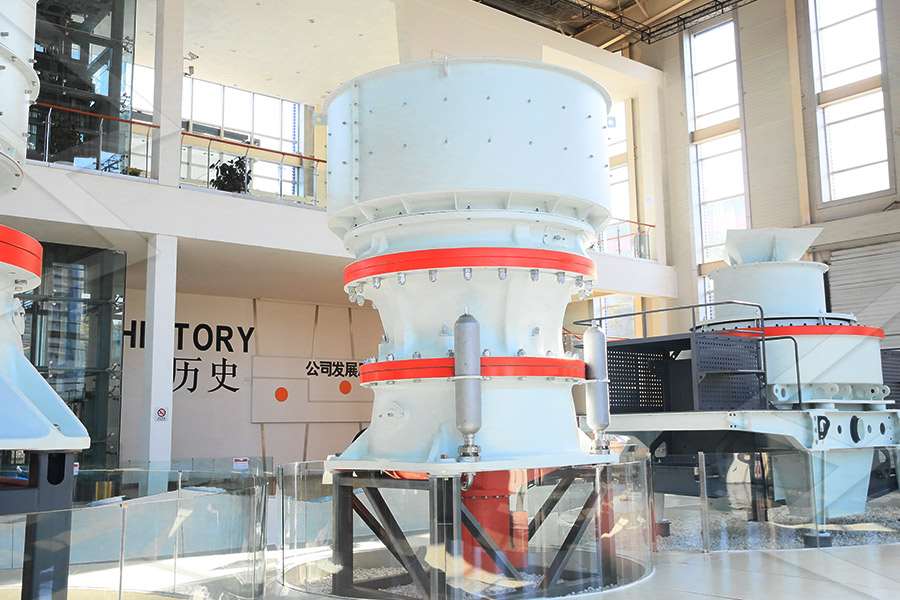

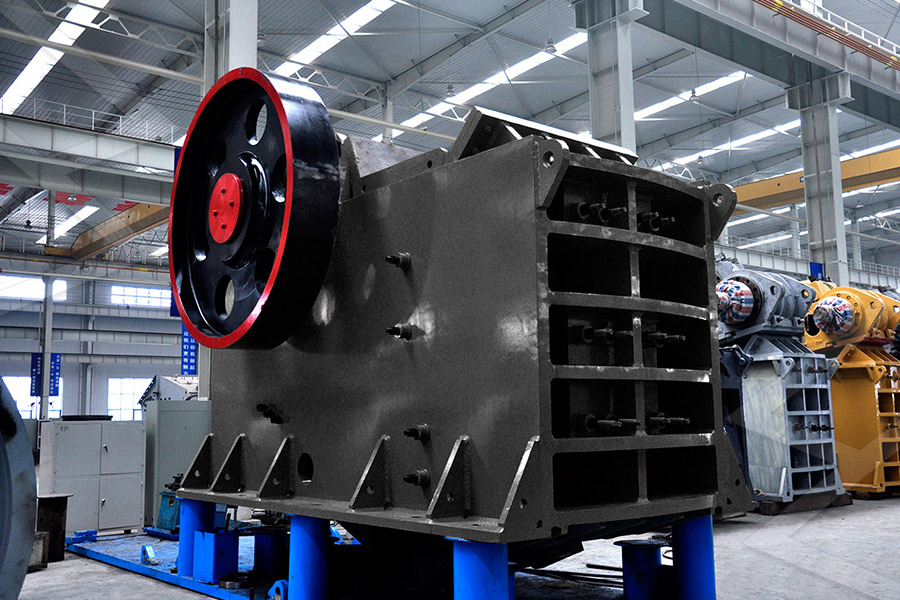

Stationary Crusher

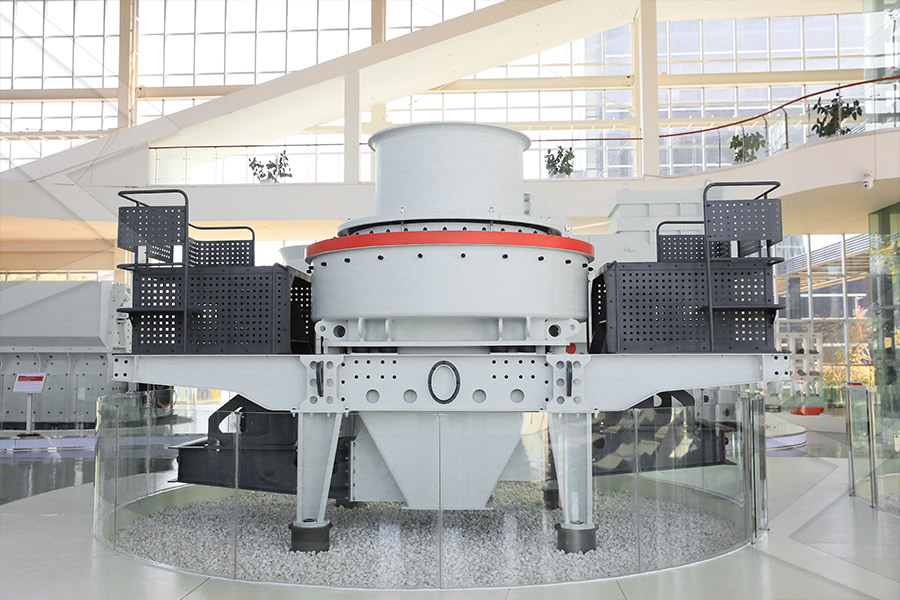

Sand making equipment

Grinding Mill

Mobile Crusher