Solved: CHAPTER CASE Bullock Gold Mining Sebo Eth Bullock

CHAPTER CASE Bullock Gold Mining Sebo eth Bullock, the owner of Bullock Gold Mining, evaluating a new gold mine in South Dakota Dan Dority, the company's geologist, has just finished his analysis of the mine site He has estimated that the mine would be productive for eight years, after which the gold would be completely minedBullock Gold Mining Case Solution Seth Bullock, the owner of Bullock Gold Mining, is assessing a brandnew cash cow in South Dakota Dan Dority, the business's geologist, has actually simply completed his analysis of the mine websiteBullock Gold Mining Case Solution Case Solution And Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority, the company's geologist, has just finished his analysis of the mine site He has estimated that the mine would be productive for eight years, after which the gold would be completely mined Dan has taken an estimate of the gold deposits to Alma Garrett, the company's financial officer Solved: Bullock Gold Mining Seth Bullock, the owner of https://caseism Get Your Bullock Gold Mining Case Study Solution Caseism is the number 1 destination for getting the case studies analyzed https://Bullock Gold Mining Case Solution Analysis Caseism CHAPTER CASE BULLOCK GOLD MINING 1 Construct a spreadsheet to calculate the payback period, internal rate of return, modif rate of return , and net present value of the proposed mine Year Cash Flow 0$650,000,000 1 80,000,000 2 121,000,000 3 162,000,000 4 221,000,000 5 210,000,000 6 154,000,000 7 108,000,000 8 86,000,000 972,000,000 Required return 12% After the fourth year, the cash flow Chapter III Case Bullock Gold Mining CHAPTER CASE

Chapter 9 Minicase Bullock Gold Mining(1) Chapter 9

1 Chapter 9 Bullock Gold Mining Name Dillon Patel Student ID Section number 2 Question conditions Year Cash flow 0 $ (525,000,000) 1 $ 74,000,000 2 $ 97,000,000 3 $ 125,000,000 4 $ 157,000,000 5 $ 185,000,000 6 $ 145,000,000 7 $ 125,000,000 8 $ 102,000,000 9 $ (35,000,000) Required return 12% Fill out all the yellow celss Payback period 439 IRR 1552% IRR 1552% MIRR The Bullock Gold Mining case can be analyzed by the use of Payback Period, NPV, IRR, and modified IRR From the calculations in the appendix, all the above calculations show positive results to imply that the project is worth investing in Therefore, the Ballock Gold mine is a viable projectThe Bullock Gold Mining Assignment Paper My Best WriterBullock gold mining case study answers corporate f bullock gold mining case study mirr lab3dnl chapter 8 case bullock gold mining answers Grinding Mill Gold mobile crusher is the newly type of gold mining machine for gold crushing and it can eliminate the obstacles of the crushing places and circumstances and offer the high efficient and low cost project plants for the clientbullock gold mining case study solution showing work Corporate Finance Case Study : Bullock Gold Mining 33,237 views Share; Like; Download Uun Ainurrofiq (Fiq) Case OverviewSeth Bullock(Owner)Dan Dority(Geologist)Alma Garrett(CFO)Hi fellaswe plan to work on a new Gold Minein South Dakota !!Not Bad based on my estimation,that site would be productive foreight year sirAlright gentleman, Chill outI’ll do the Corporate Finance Case Study : Bullock Gold MiningThe Bullock Gold Mining case can be analyzed by the use of Payback Period, NPV, IRR, and Corporate Finance Case Study : Bullock Gold Mining 18 Apr 2013 Corporate Finance Case Study : Bullock Gold Mining DOWNLOAD THE BOOK INTO AVAILABLE FORMAT New Update Payback Period Spreadsheet *Formula Payback Period in C15 =C7/ B8 3*Formula Disc sample of bullock gold mining payback period

(DOC) Bullock Gold Mining Dr Elijah Clark Academiaedu

Academiaedu is a platform for academics to share research papersMiniCase Study: Bullock Gold Mining Seth Bullock, the o wner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority, the company's geologist, has just finished his analysis of the mine site He has estimated that the mine would be more productive for either years, after which the gold would be completely mined Dan has taken an estimate of the gold MiniCase Study: Bullock Gold Mining BrainMassMINICASE Bullock Gold Mining Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority the company's geologist, has just finished his analysis of MINICASE Bullock Gold Mining Seth Bullock, the owner of Download Ebook Bullock Gold Mining Case Solution Bullock Gold Mining Case Solution Thank you for downloading bullock gold mining case solution As you may know, people have look numerous times for their chosen books like this bullock gold mining case solution, but end up in malicious downloads Rather than enjoying a good book with a cup of coffee in the afternoon, instead they Bullock Gold Mining Case Solution agnoleggioitChapter III Case Bullock Gold Mining CHAPTER CASE CHAPTER CASE BULLOCK GOLD MINING 1 Construct a spreadsheet to calculate the payback period, internal rate of return, modif rate of return,and net present value of the proposed mine Year Cash Flow 0$650,000,000 1 80,000,000 2 121,000,000 3 162,000,000 4 221,000,000 5 210,000,000 6 154,000,000 7 108,000,000 8 86,000,000 sample of bullock gold mining payback zubnirakovnikcz

finding the npv of bullock gold mining

Chapter III Case Bullock Gold Mining CHAPTER CASE CHAPTER CASE BULLOCK GOLD MINING 1 Construct a spreadsheet to calculate the payback period, internal rate of return, modif rate of return , and net present value of the proposed mine Year Cash Flow 0$650,000,000 1 80,000,000 2 121,000,000 3 162,000,000 4 221,000,000 5 210,000,000 6 154,000,000 7 108,000,000 8 86,000,000 The Bullock Gold Mining case can be analyzed by the use of Payback Period, NPV, IRR, and Corporate Finance Case Study : Bullock Gold Mining 18 Apr 2013 Corporate Finance Case Study : Bullock Gold Mining DOWNLOAD THE BOOK INTO AVAILABLE FORMAT New Update Payback Period Spreadsheet *Formula Payback Period in C15 =C7/ B8 3*Formula Disc sample of bullock gold mining payback periodBullock Gold Mining Solution Chapter 9 Bullock Gold Mining Input area Year Cash flow 1 2 from BUSINESS 1111 at University of Texas, Dallas solution construc the spreadsheet bullock gold solution construc the spreadsheet bullock gold mining Solved Bullock Gold Mining Seth Bullock, the owner of Bull Chegg Bullock Gold Mining Corporate Finance Minicase Bullock Gold Bullock Gold Mining Payback Period ExcelSolutions; Contact Us; News Customer satisfaction is the core of all our service Home; Finding The Npv Of Bullock Gold Mining; Finding The Npv Of Bullock Gold Mining Send : [ protected] Submit Message Inquiry Online Bucket Elevator Fote bucket elevator enjoys the features of large working capacity, stable performance and long service life, etc Read More Stone Crusher Mining Finding The Npv Of Bullock Gold MiningClosing Case: Bullock Gold Mining 269 CHAPTER EIGHT Making Capital Investment Decisions 270 81 Incremental Cash Flows 270 Cash Flows—Not Accounting Income 270 Sunk Costs 271 Opportunity Costs 271 Side Effects 272 Allocated Costs 272 82 The Baldwin Company: An Example 273 An Analysis of the Project 274 Investments 274 Income and Taxes 275 CORE PRINCIPLES AND APPLICATIONS OF CORPORATE FINANCE

Bullock Gold Mining Case Solution agnoleggioit

Download Ebook Bullock Gold Mining Case Solution Bullock Gold Mining Case Solution Thank you for downloading bullock gold mining case solution As you may know, people have look numerous times for their chosen books like this bullock gold mining case solution, but end up in malicious downloads Rather than enjoying a good book with a cup of coffee in the afternoon, instead they MINICASE Bullock Gold Mining Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority the company's geologist, has just finished his analysis of MINICASE Bullock Gold Mining Seth Bullock, the owner of MiniCase Study: Bullock Gold Mining Seth Bullock, the o wner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority, the company's geologist, has just finished his analysis of the mine site He has estimated that the mine would be more productive for either years, after which the gold would be completely mined Dan has taken an estimate of the gold MiniCase Study: Bullock Gold Mining BrainMassChapter III Case Bullock Gold Mining CHAPTER CASE CHAPTER CASE BULLOCK GOLD MINING 1 Construct a spreadsheet to calculate the payback period, internal rate of return, modif rate of return , and net present value of the proposed mine Year Cash Flow 0$650,000,000 1 80,000,000 2 121,000,000 3 162,000,000 4 221,000,000 5 210,000,000 6 154,000,000 7 108,000,000 8 86,000,000 finding the npv of bullock gold miningClosing Case: Bullock Gold Mining 269 CHAPTER EIGHT Making Capital Investment Decisions 270 81 Incremental Cash Flows 270 Cash Flows—Not Accounting Income 270 Sunk Costs 271 Opportunity Costs 271 Side Effects 272 Allocated Costs 272 82 The Baldwin Company: An Example 273 An Analysis of the Project 274 Investments 274 Income and Taxes 275 CORE PRINCIPLES AND APPLICATIONS OF CORPORATE FINANCE

ww2justanswer

Sheet3 Sheet2 Sheet1 Bullock Gold Mining Year Cash Flow 1) Payback Period Beginning Unrecovered Investment Cash Inflow Ending Unrecovered Investment yearsMini Case: Bullock Gold Mining 170 CHAPTER 6 Making Capital Investment Decisions 171 61 Incremental Cash Flows: The Key to Capital Budgeting 171 Cash Flows—Not Accounting Income 171 Sunk Costs 172 Opportunity Costs 172 Side Effects 173 Allocated Costs 173 62 The Baldwin Company: An Example 174 An Analysis of the Project 176 Which Set of Corporate Finance GBV Bullock Gold Mining Case Study Solution Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority, the company’s geologist, has just finished his analysis of the mine site He has estimated that the mine would be productive for eight years, after which the gold would be completely mined Dan has taken an estimate of the gold deposits to (Solved) Construct a spreadsheet to calculate the This chapter presents an exploratory analysis of different stages in the gold production cycle, notably exploration, mining, processing, and refining It analyzes key technological changes, as (PDF) SME Mining Engineering Handbook, Third Edition This is an explaination of Essentials of Corporate Finance Chapter 3 end of chapter caseChapter 3 End of Chapter Case YouTube

- vsi crusher bearings

- process of benification in pellate plant

- casting metals in dentistry past present

- mining ore crusher made in malaysia

- Ce Certificated Fine Vibrating Feeder

- sawmill equipment supplies amp b services

- gold mining in kalgoorlie

- maximus crushing amp screening

- manufacture of quartz crushed machine

- introduction of al handling belt nveyor system

- silica sand grinding machine dijual di india

- gxc1300 efficient ne crusher

- brick crusher for sale india agnespelekas m

- Jaw And Cone Crusher Combernation

- sand suppliers in thane west

- manufacturer of silica sand processing 0 55 mm

- crushers south mongolia

- jally rate in bangalore

- cement grinding mill bangladesh

- nigeria gold mining site in kano

- press filter of filtration of stevia extraction line

- POSITIVE EFFECTS OF STRIP MINING

- plant for lead stone mozambique

- used ne crusher france

- perimeter fencing digging machines

- GOLD ORE VIBRATING CRUSHER MACHINE

- small rock crushing equipment

- list of crusherpanies in india

- top ten manufacturer of stone crusher in the world

- Best Method Of Starting A Stone Crusherstone Quarry Plant India

- price of jaw crusher primary used

- plant picture of sonar baangla cement sagardighi

- small dolimite crusher in india

- mobile dry gold revery equipment

- used mobile screening plants sale

- Cost In India For Setup A Mini Ciment Mill Plant

- limitations about rod mill

- quarry crusher model no3283mod5

- picadora cutter sammic sk 8

- pakistan sand afreesms to pakistan

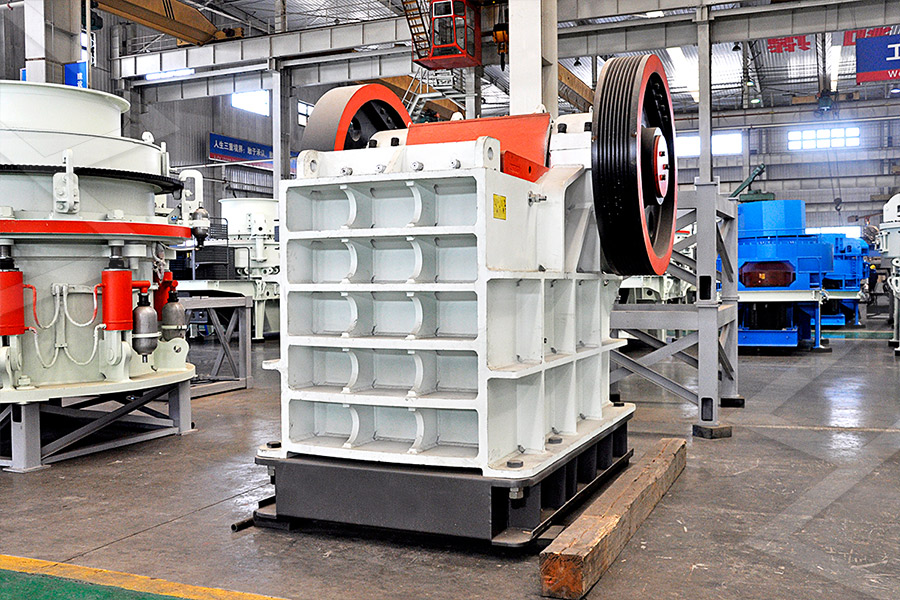

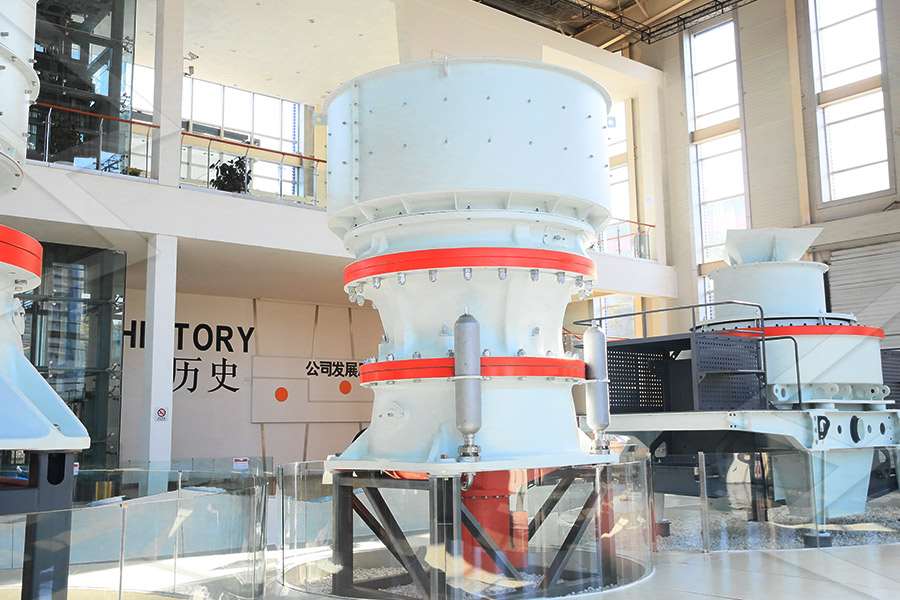

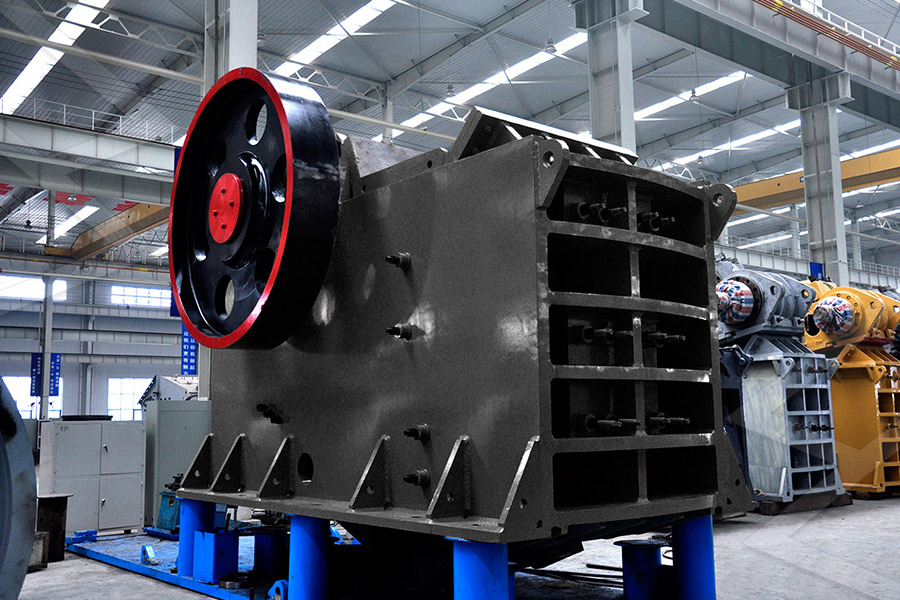

Stationary Crusher

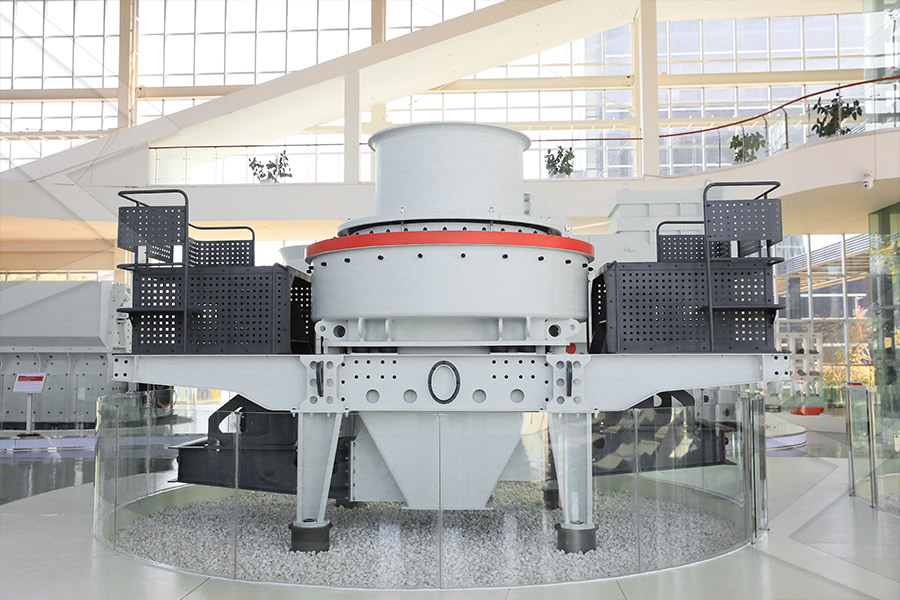

Sand making equipment

Grinding Mill

Mobile Crusher