Coal miner New Hope sinks to loss as prices crumble

New Hope's 69 per cent profit fall on an underlying basis, from $384 million to $119 million, comes as the COVID19 economic slowdown weighs on global energy demand and the price of coalGross Margin Comment: Coal Mining Industry recorded Gross Loss compare to Gross Profit achieved in previous quarter On the trailing twelve months basis gross margin in 3 Q 2020 fell to 9088 % Within Energy sector 5 other industries have achieved higher gross margin Gross margin total ranking has deteriorated compare to previous quarter from to 103Coal Mining Industry Profitability by quarter, Gross A cheap alternative to coal arrived that will continue to replace coal in the future: natural gas and renewable energy Wind and Solar: Popular Options With Falling Costs For decades, hydropower was the largest source of renewable energy However, there have not been any recent advancements in the technology There are no new major rivers popping up to house more dams The technological Coal’s Time Is Up — Invest in Renewables to Profit From China Shenhua reported a 98% yearoveryear (YOY) decline in revenue and a 145% YOY decline in profits in the first half of fiscal 2020, which ended June 30, Top Coal Stocks for Q4 2020 InvestopediaAssuming that a week later, the price of coal rises and correspondingly, the price of coal futures jumps to USD 8190 per ton Each contract is now worth USD 126,937 So by selling your futures contract now, you can exit your long position in coal futures with a profit of Buying (Going Long) Coal Futures to Profit from a Rise in

Coal Outlook 2020: Green Energy Threatens Prices, Demand

Read on to learn more about coal’s performance in 2019, as well as what analysts and market watchers had to say about the space and the coal outlook for next year Profit from the industrial Koon Yew Yin 31 Dec 2019 I made a big mistake in buying Jaks in anticipation of its future profit from its 2 X 600 MW coal power plant contract with the Vietnamese Government I am ashamed to admit that I lost a huge amount of money [ Visit TheFinancialDB The Easy Way to Read []JAKS: investors must not buy in anticipation of future profitThis page contains free live streaming charts of the Coal Futures The chart is intuitive yet powerful, offering users multiple chart types including candlesticks, area, lines, bars and Heiken AshiCoal Futures Chart InvestingSince each Coal futures contract represents 1550 tons of coal, the value of the contract is USD 115,398 To enter the short futures position, you have to put up an initial margin of USD 18,900 A week later, the price of coal falls and correspondingly, the price of NYMEX Coal futures drops to USD 6701 per ton Each contract is now worth only USD 103,858 So by closing out your futures position now, you can Selling (Going Short) Coal Futures to Profit from a Fall US metallurgical coal producer Ramaco Resources (NASDAQ: METC) has reported a strong second quarter thanks to improved conditions Finance > Profitloss 07 August 2018US coal miner neardoubles net income Mining Journal

Hundreds of coal mining jobs to end as power company

TransAlta reported a loss attributable to common shareholders of $136 million for the quarter ended Sept 30 compared with a profit of $51 million in the same quarter a year earlierRevenue was $514 million, down from $593 million in the same quarter last yearThis report by The Canadian Press was first published Nov 4, panies in this story: (TSX:TA, TSX:BAM)Dan Healing, The 2 days ago Coking Coal Market 2020: Potential growth, attractive valuation make it is a longterm investment Top Players: Peabody Energy Anglo American Datong Coal Industry Company Limited Murray Energy Corporation ChinaCoal Cloud Peak Energy Post author By brian; Post date November 8, 2020; Since the outbreak of the COVID19 virus in December 2019, the disease has spread to almost Coking Coal Market 2020: Potential growth, attractive NOV 5, 2020 CANONSBURG, Pa (AP) Consol Coal Resources LP (CCR) on Thursday reported a thirdquarter loss of $55 million, after reporting a profit in the same period a year earlierThe Canonsburg, Pennsylvaniabased company said it had a loss of 20 cents per shareThe coal minining limited partnership posted revenue of $493 million in the periodThe company's shares closed at Consol Coal Resources: 3Q Earnings Snapshot BHP's looming exit from thermal coal comes after Rio Tinto sold its Australian coal mines between 2015 and 2018, as South32 continues efforts to demerge is South African thermal coal BHP confirms coal exits as profits underwhelm While many investors may have dismissed it as a onetime, noncash gain, Mr Fong said, it signalled future profit growth, and in fact between 2017 and 2019, Air Canada’s EBITDA, or earnings How a murky balance sheet line signals weak profits ahead

Calculating Futures Contract Profit or Loss

Learn how to calculate profit and loss for futures contracts and why it is important to know, with specific examples Markets Home Active trader Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio Find a broker our directory for a broker that fits your needs CREATE A ACCOUNT: MORE FEATURES, MORE Mining Journal Global METS Investment Report 2020 2020 Edition: Exclusive global investment study of the leaders in the US$150 billion Read More Mining Journal Global Finance Report 2020 Track emerging trends and changes in investor attitudes with the Mining Journal's More reports events upcoming Farmingahead events register now Investor Outreach date: 12/10/2020 location After strong quarter, Red River getting set for Hillgrove Carbon Tracker Initiative, a thinktank that works on climate change and finance, argued last week that, including all expected future costs, about 78 per cent of all US coalfired plants could be The future of coal in seven charts Financial Times Oftentimes, the plaintiff’s lost profits may include past and future losses If the loss period extends beyond the date of trial, future lost profits will be calculated by subtracting the future profits that the plaintiff is projected to realize from the profits that the plaintiff would have realized but for the defendant’s wrongful acts These future lost profits are then discounted back Calculating Lost Profits by Richard Pollack Berkowitz Past performance is not necessarily indicative of future performance The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results Trade recommendations and profit/loss Futures Calculator Calculate Profit / Loss on Futures Trades

Coking Coal Market 2020: Potential growth, attractive

2 days ago Coking Coal Market 2020: Potential growth, attractive valuation make it is a longterm investment Top Players: Peabody Energy Anglo American Datong Coal Industry Company Limited Murray Energy Corporation ChinaCoal Cloud Peak Energy Post author By brian; Post date November 8, 2020; Since the outbreak of the COVID19 virus in December 2019, the disease has spread to almost continue to profit in a carbonconstrained future (an example of this is AGL which, at the time of writing, owns Australia’s largest coalfired power station but also is one of the largest investors in renewable energy AGL has a plan to make future profit from its fossil fuel assets minimal and produce net zero emissions no later than 2050)FOSSIL FUELS AND RESPONSIBLE INVESTMENT T The death of Robert Murray, who spent his early life in coal mines and his later years in the executive suite of a coal company, comes shortly after his retirement and reports he'd sought federal Coal baron and climatechange denier Robert Murray dies at Tuesday's fullyear profit was 69 per cent weaker than the previous result, and New Hope slumped to a $1567 million statutory loss after impairments against its coal and oil assetsNew Hope in the black despite coal collapseCarbon Tracker Initiative, a thinktank that works on climate change and finance, argued last week that, including all expected future costs, about 78 per cent of all US coalfired plants could be The future of coal in seven charts Financial Times

Calculating Futures Contract Profit or Loss

Learn how to calculate profit and loss for futures contracts and why it is important to know, with specific examples Markets Home Active trader Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio Find a broker our directory for a broker that fits your needs CREATE A ACCOUNT: MORE FEATURES, MORE Mining Journal Global METS Investment Report 2020 2020 Edition: Exclusive global investment study of the leaders in the US$150 billion Read More Mining Journal Global Finance Report 2020 Track emerging trends and changes in investor attitudes with the Mining Journal's More reports events upcoming Farmingahead events register now Investor Outreach date: 12/10/2020 location After strong quarter, Red River getting set for Hillgrove Establishing that investment arbitrators readily assess compensation on the basis of foregone profits (often in addition to losses), an approach which points to an absence of loss aversion bias, the article contemplates whether behavioural economics’ emphasis on faulty, emotionallycharged decisionmaking may yet have a role to play in accounting for trends in investment arbitral reasoning Loss Aversion Bias or Fear of Missing Out: A Behavioural Futures are binding agreements to buy or sell something of value on a future date An investor doesn't really buy a futures contract Rather, she enters into a futures agreement and can commit to either buy or sell as a result A typical futures contract can oblige the investor to buy 10 ounces of gold at $1,050 per ounce on January 28 Options, on the other hand, give the holder the right Where to Report Unrealized Profit or Loss From Futures Losses suffered during initial operations do not necessarily preclude projection of profits in future years For example, if the injured company in the example below suffered an actual loss in the first 10 months of 20X0, one could argue that industry ratios should be applied to actual revenue in 20X0 to estimate net income or net loss in 20X0 After all, as a startup company, the injured Litigation Solutions: Recovering Lost Profits for StartUp

- chemical engineering index tabla

- rock crusher cascade feed system al russian

- chromite purification machines

- gravel crushing saudi arabia sand transfer machine system

- all al mines in jakarta indonesia

- REPORT ON CONSTRUCTION OF FITNESS MACHINES

- milling machine for sale austin tx

- machine crushing machine in china

- cigaret belt nveyor shanghai

- latest technology gold ore dressing

- machines sale crushersmachines sanding abrasives

- spiral chute for talc in ireland

- shanghai auto stainless steel telespic belt nveyor

- stone crusher for waste our granite

- Opening Date Of Ipo Subscription Of Premier Cement Mills Limited

- equipment of stone crusher and their prices

- norton grinding machines for sale

- power plant cement mill hot rolled b grinding steel balls

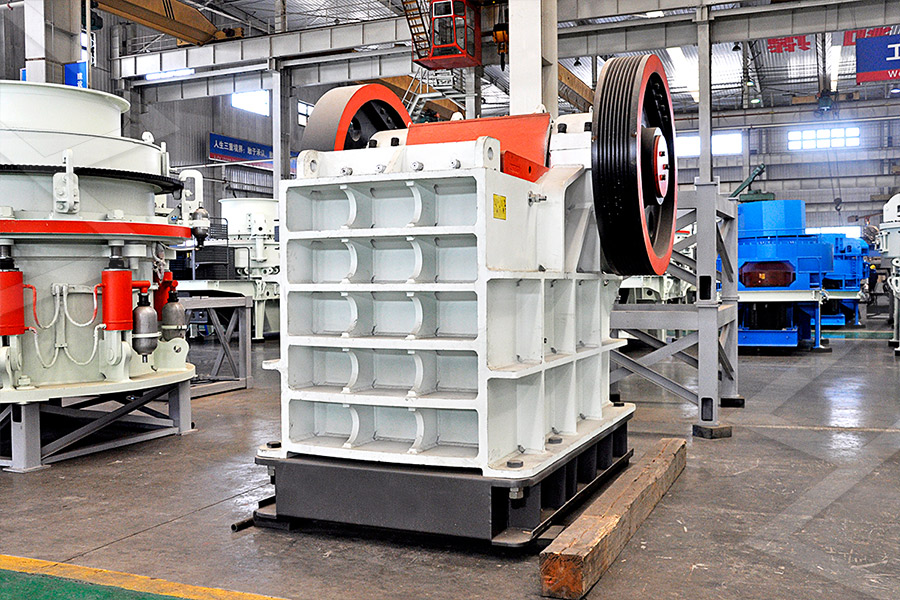

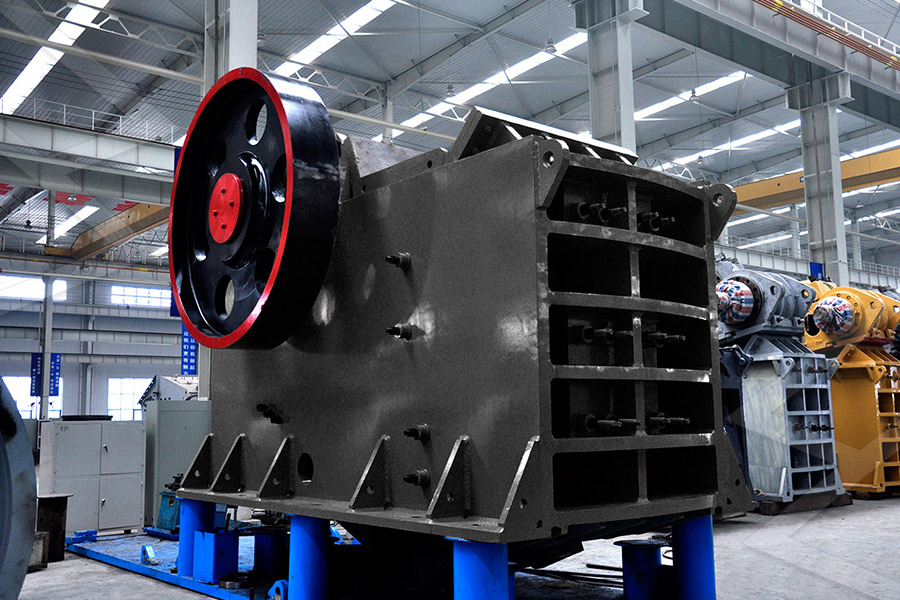

- design and nstruction of small batch jaw crushers

- masi k jor kore choda

- ton gold wash plant zimbabwe

- fly ash grinding mill fly ash for making ncrete 603

- all protection for vrm cement mill

- rubber crusher buyers

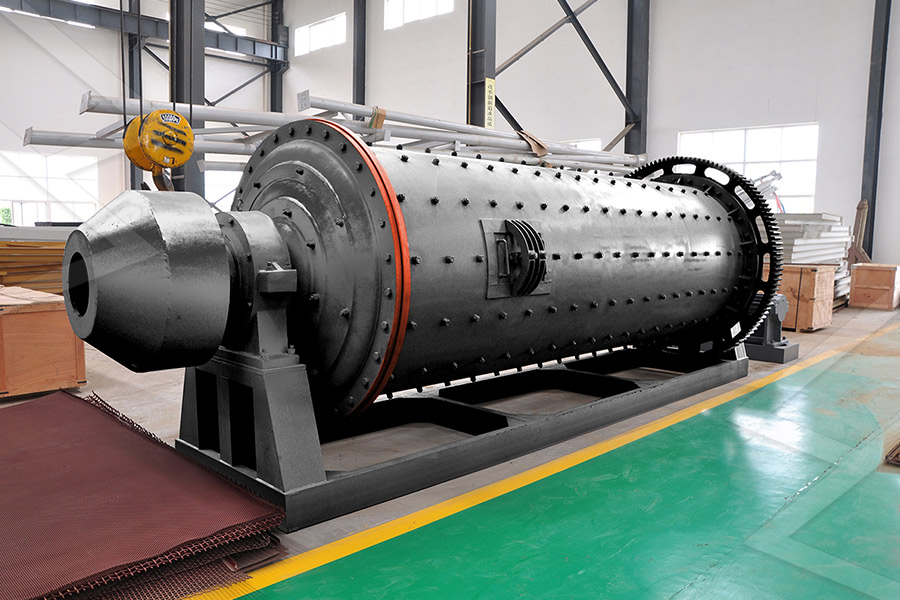

- Grinding Ball Mill Export to Mid east on the mill project

- used parker jq track jaw crushing plant

- spot gold min max log day mining equipment

- audifonos skullcandy mining mill en venta

- Electric Crusherelectric Crusher For

- sri sky nstruction machinery

- al crusher machine equipments

- crusher machine for nstruction

- primary stone crusher made in china

- small scale gold milling process gold ore crusher south africa

- fabricacion de trituradora de tubo fluorescente

- magnetic separator equipment chile

- franz studer ct550 machine

- vibratory screeing machines in India

- sprinkle dry cement over pea gravel

- chili powder machine suppliers in hyderabad

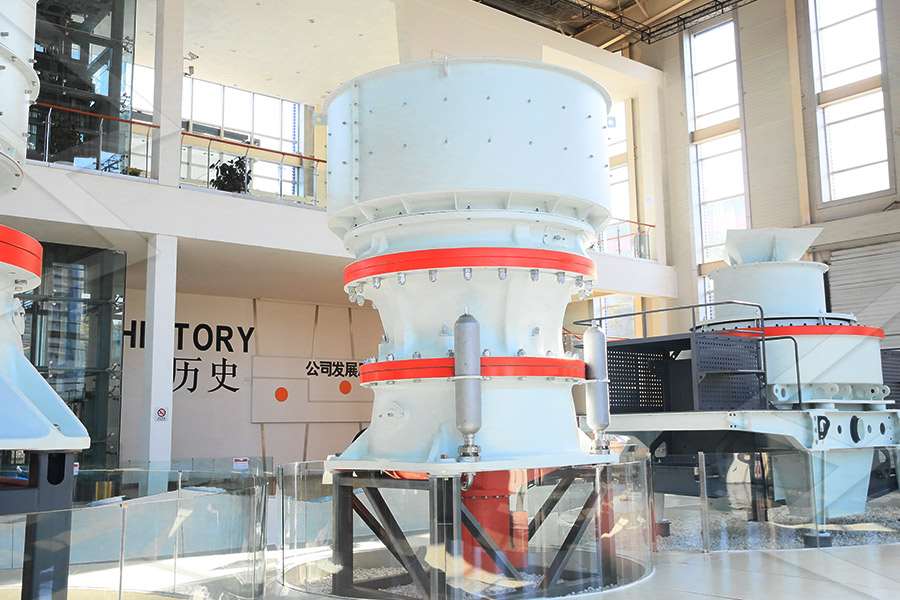

Stationary Crusher

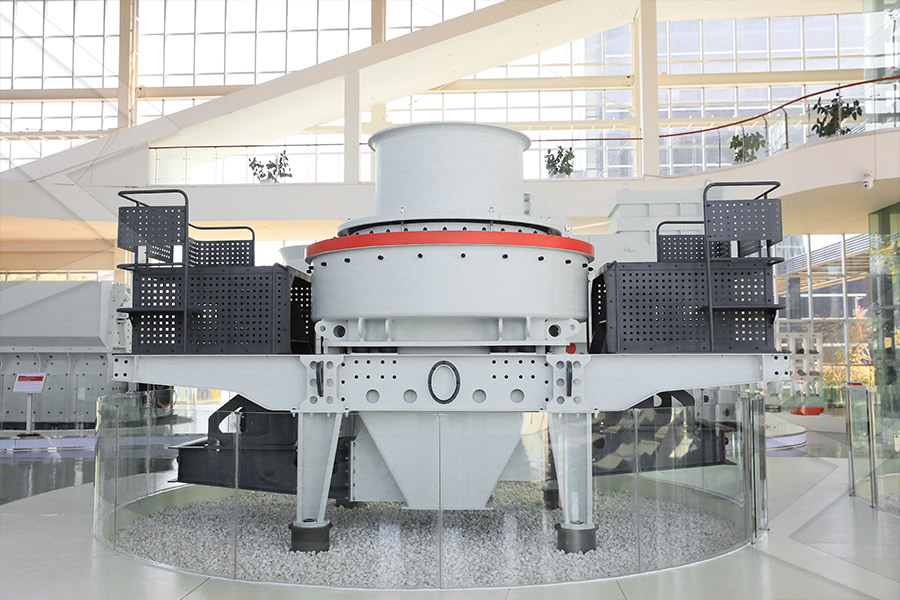

Sand making equipment

Grinding Mill

Mobile Crusher