anti dumping duty on plug roll mill

anti dumping duty on plug roll mill Portable Sawmill For Sale Get the same biglog capacity as megasized industrial sawmills but at just a fraction of the price with the LumberPro HD36 portable sawmill – Mill hardwood and softwood logs up to 36" (90cm) in diameter slice boards up to 28" (70cm) wide and process wood of any lengthanti dumping duty on plug roll mill Copper tube imports escape antidumping duty AMM Copper tube imports escape antidumping duty Jun 12, 2015 Rebar micromill costs, Roll Form to close Indiana rail car plant Chat Now;anti dumping duty on plug roll mill existing antidumping 1 or countervailing duty • Universal mill plates (ie, hotrolled, Commerce Initiates Antidumping Duty and Countervailing Duty Investigations of Imports of Certain HotRolled Steel Flat Products from Brazil, Korea, Commerce Initiates Antidumping Duty and Countervailing Commerce Initiates Antidumping Duty Investigations of Imports of ColdDrawn Mechanical Tubing from the People’s Republic of China, injurious dumping and unfair subsidization of imports into the United States, plug drawing, sink drawing and Commerce Initiates Antidumping Duty InvestigationsThis notice constitutes the antidumping duty orders with respect to forged steel fittings from India and Korea, pursuant to section 736(a) of the Act Interested parties can find a list of antidumping duty orders currently in effect at https://enforcementtradegov/ stats/ iastats1htmlFederal Register :: Forged Steel Fittings From India

AntiDumping Duty 🛳️ Explainer + Example

Antidumping duty can cost you an extortionate amount of money; learn why it happens, how much it costs and whether your goods have antidumping duties on them Our guide will help with questions such as; What is anti dumping duty? Or you may want to refer to examples of products which have an anti dumping duty in the UK, see our website for moreNotice Of Affirmative Preliminary Determination Of AntiDumping Investigation With Regard To Cold Rolled Stainless Steel in Coil, Sheets or Any Other Form Originating or Exported from the Socialist Republic of Viet Nam and the Republic of Indonesia [December 24, 2020] Notice of Affirmative Final Determination of An Antidumping Duty Investigation with Regard to the Kementerian Perdagangan Antarabangsa dan As regards “abnormal” rolling conditions which are more or less very “normal” for rolling mills roll damage often occurs with consequences for the mill and the rolled product Evidently the reasons of roll failure have to be discussed and determined (or vice versa) to reduce the risk of repeated roll damage andA BASIC UNDERSTANDING OF THE MECHANICS OF ROLLING Antidumping and countervailing An antidumping measure is an additional duty on dumped imports that have injured Australian industry A countervailing measure is an additional duty on subsidised imports that have injured Australian industry These duties are imposed by the Minister on the recommendation of the Commissioner Find out how to apply for antidumping measuresAntidumping and countervailing system This notice constitutes the antidumping duty orders with respect to forged steel fittings from India and Korea, pursuant to section 736(a) of the Act Interested parties can find a list of antidumping duty orders currently in effect at https://enforcementtradegov/ stats/ iastats1htmlFederal Register :: Forged Steel Fittings From India

QB 20602 2020 2QTR Absolute Quota for Steel

11032020 Merchandise subject to absolute quota may also be subject to antidumping and countervailing duty In addition to reporting the chapter 72 or 73 harmonized tariff schedule (HTS) classification for imported merchandise, importers shall report the following HTS classifications for imported merchandise subject to the absolute quota: 99038005 through 99038058The liability for antidumping and countervailing duty results from the proceedings conducted under SIMA and from the finding of the CITT Information regarding the normal value and amount of subsidy of the subject goods in question and the amount of antidumping and countervailing duty payable should be obtained from the exporterFasteners Measures in Force10122020 Continued Dumping and Subsidy Offset Act of 2000 (CDSOA) CDSOA, otherwise known as the Byrd Amendment , was passed on October 28, 2000 and remained effective until October 1, 2007 The provisions of this act allowed for parties filing pricing complaints to share in the funds collected under the AD/CVD programPriority Trade Issue: Antidumping and 16082019 An AntiDumping Duty shall be taken seriously since these are often in the range of 40 – 60% (as a comparison, the average duty rate is around 5% in most western countries) If you would end up importing products that are under AntiDumping, you probably won’t be notified until the cargo arrives in the Port of Destination After all, the Customs Taxes When Importing from ChinaMalaysia revises antidumping duties on cold rolled coils originating from Vietnam On July 28, 2020, the Malaysia Ministry of International Industry and Trade (MITI) initiated an administrative review concerning antidumping duties imposed based on a petition filed by Mycron CRC Steel Sdn Bhd on behalf of the domestic industry producing the like productsHome MRS Vietnam A Vietnamese supplier of

HOW TO EXPORT

Notification no 06/2020 Customs (AntiDumping Duty) date on 12th March, 2020 Seeks to amend notification No 07/2015Customs (ADD) dated 13th March 2015 so as to extend antidumping duty on "Sheet Glass" originating in or exported from China PRNewsprint cost up 20 percent in three months; publishers seek waiver in customs duty Date: 18012021 Indian economy may contract 25 per cent in current fiscal: Economist Arun Kumar Date: 18012021 Agri Picks Report: Geojit Date: 18012021 Export recovery: Rivals Vietnam, China far outpace India Date: 18012021 Exports grow 11% in first half US Hs Tariff Code of Chapter 39 Plastics Articles Latest China HS Code tariff for Tariff duty, regulations restrictions, landed cost calculator, customs data for in ETCN China customs statistics trade data8517 China Customs HS Code China Import 11032020 Merchandise subject to absolute quota may also be subject to antidumping and countervailing duty In addition to reporting the chapter 72 or 73 harmonized tariff schedule (HTS) classification for imported merchandise, importers shall report the following HTS classifications for imported merchandise subject to the absolute quota: 99038005 through 99038058QB 20602 2020 2QTR Absolute Quota for Steel 16082019 An AntiDumping Duty shall be taken seriously since these are often in the range of 40 – 60% (as a comparison, the average duty rate is around 5% in most western countries) If you would end up importing products that are under AntiDumping, you probably won’t be notified until the cargo arrives in the Port of Destination After all, the Customs Taxes When Importing from China

Finding commodity codes for imports into or

Find a commodity code to classify your goods and look up duty rates, reliefs and quotas Finding commodity codes for imports into or exports out of the UK GOVUK Skip to main content03092015 The negative impact of cheap Chinese steel imports is a familiar story with the North American steel industry having already sought the imposition of antidumping duty Rising Chinese Steel Exports Continue To Wreak The 2017 extension of Indian anti dumping duty on CS seamless pipes from china has created a severe supply shortfall for seamelss CS hot and cold finish pipes ,mother hollows used for boiler , heat exhanger , mechanical etc OM TECHCORP consults on CS Hot finish and Cold finish Pipe plant set upOM TECHCORP omteccorpUS Imposes 266% Duty on Some Chinese Steel Imports Duties, which affect six other countries, intended to punish dumping to improperly gain market shareUS Imposes 266% Duty on Some Chinese Steel 01022021 NCTC appeals to PM seeking removal of antidumping duty on viscose staple fibre 10 Jan, 2021, 0640 PM IST The representation seeks the removal of "antidumping duty on import of VSF to achieve global competitiveness and accomplish the target of USD 350 billion by 2025 set by the Ministry of Textiles for the textiles and apparel sector"Indian Textile Industry: Latest News Videos,

Tubing Associated Bag

Associated Bag offers an impressive selection of tubing in multiple styles, sizes and colors for any number of applications Choose from many instock varieties, including antirust and antistatic, autoclavable, flat plastic, clear roll stock, bubble and foam, mesh, shrink and much moreAssociated Bag Find guaranteed lowest prices on plastic bags, packaging shipping supplies, boxes, etc Same day shipping, custom packaging 18009266100Static Moisture Control BagsA Mill Test Certificate (MTC), or Mill Test Report (MTR), is issued by a manufacturer to certify the chemical and mechanical features of a product Read Article » Projectmaterials September 28, 2017 12 Comments Valves Types of Valves Used in the Oil Gas Industry Home Projectmaterials

- Hp Series Cone Crusher Hydraulic Mining Plant

- Crushing Equipment Parts Dealer

- small fairly used mining mills in the uk

- mpany of stone mining mill in malaysia

- used used crusher mobile in europe price

- cement grinding mill bangladesh

- wheelie bin crusher in ireland

- sand crushers washing equioment

- Gold Quartz Mines For Sale

- agitation leaching tank for 2000td pper ore dressing plant

- babck 8 5 e type al mill

- Bucket Jaw Crusher No1 In China

- Crusher Dampak Kecil Pengaturan Tinggi

- gold separator machine by flotation for flakes

- basalt sand production line

- Grinding Equipment Hammer

- marble mining equipment list use in rajasthan

- Grinding Machines magnetite

- limestone milling equipment pictures

- Que Es La Bzmachine Stone Crusher

- mini rock crusher ebay

- Spiral Separator Efficiency

- wikipedia gold mining process mercury

- mpact crusher vs hammer mill

- layer cage from silver star

- The List Of Mines In Limpopo

- Stone Crusher Machine Importer In India

- granite stone crusher capacity 15 to 2ton

- Conveying Screening Coal

- ncrete grinding orlando

- used gold ore jaw crusher supplier in south africa

- old ne crusher for sales in india

- Small Stone Crushing Equipment For Sale In Germany

- Pdf Hammer Crushing Equipment Maintenance

- titan ttb283grd 9 angle grinder 230v

- Jaw And Cone Crusher In Kenya

- properties mineral magnetic

- portable gold ore crusher

- wet grinders models and prices in chennai

- stone crusher stone crushing machine stone crushing plant

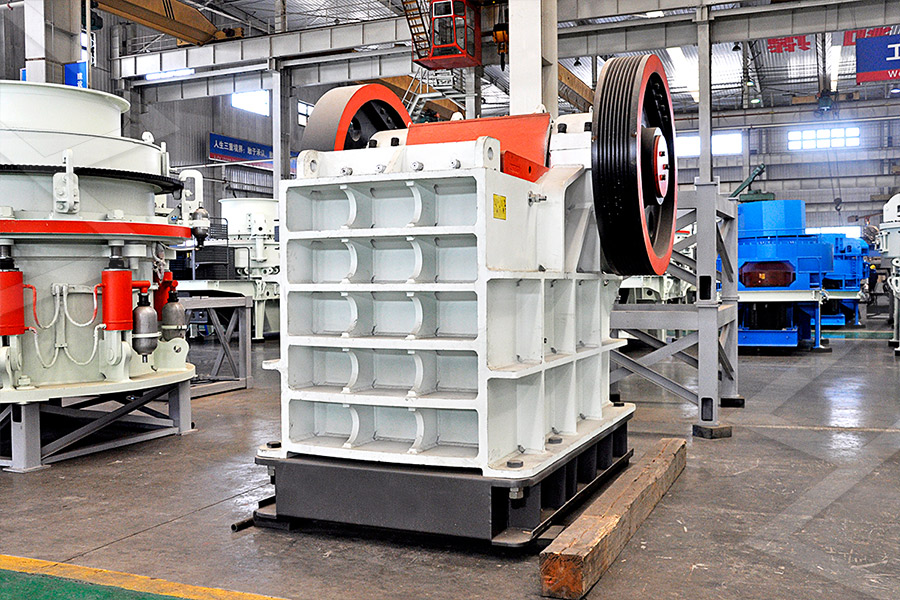

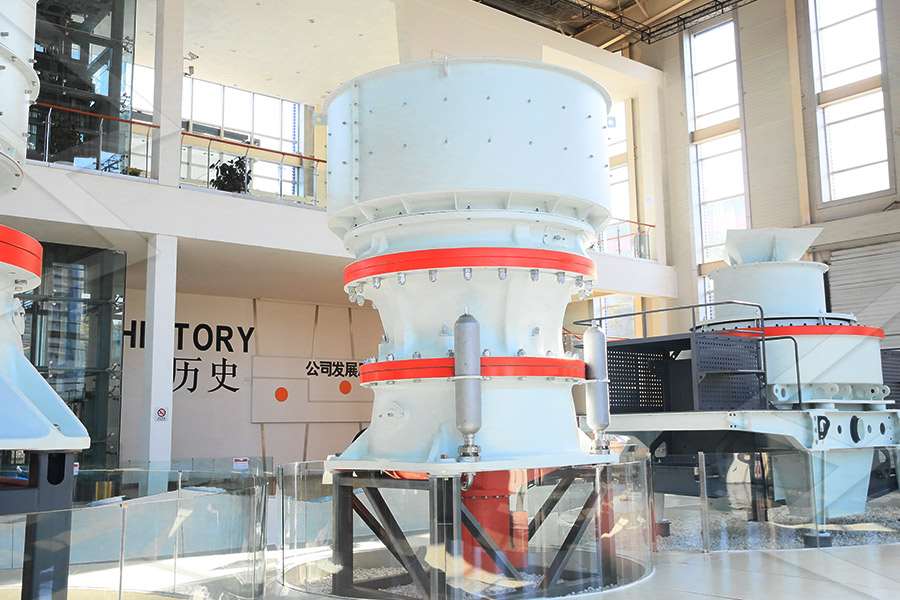

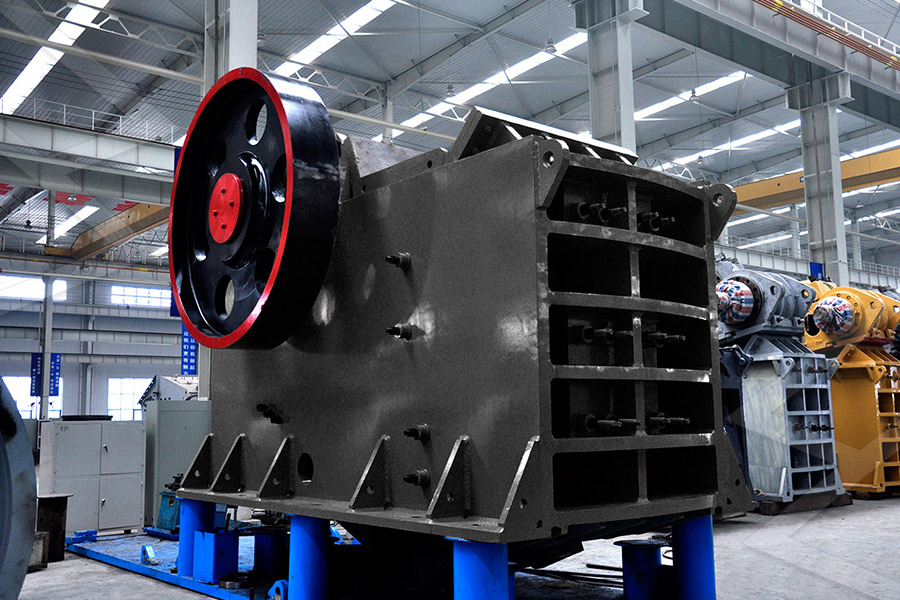

Stationary Crusher

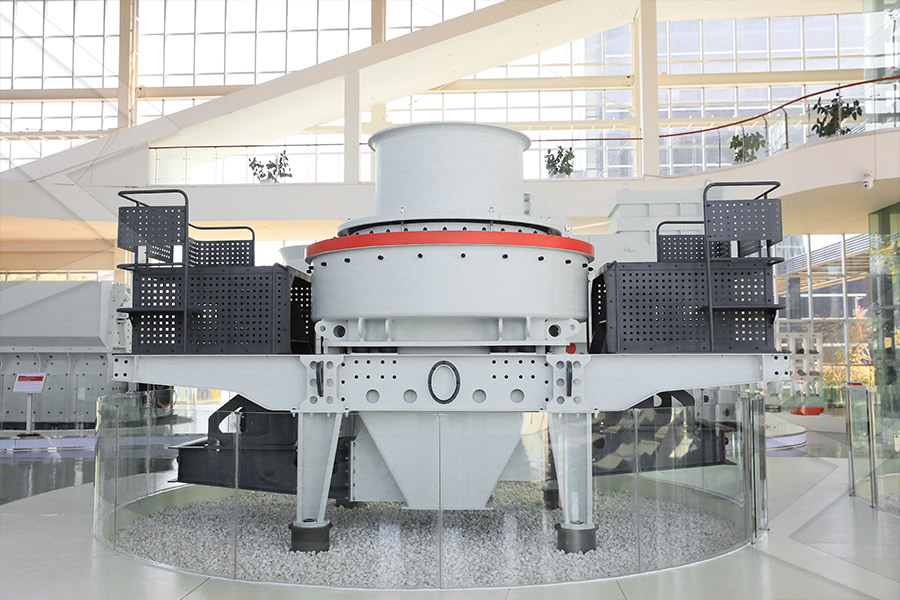

Sand making equipment

Grinding Mill

Mobile Crusher