New venture capital incubation fund targeting smallscale

JOHANNESBURG (miningweekly) – Venture capital incubation fund initiator Pearl Gray Equity Partners is targeting South Africa’s smallscale gold mining space Pearl Gray, a reform of the GrayOHANNESBURG (miningweekly) – Venture capital incubation fund initiator Pearl Gray Equity Partners is targeting South Africa’s smallscale gold mining space Pearl Gray, a reform of the Gray Family trust created in the late 1990s, is a family investment firm based in Pretoria, with activities in Delaware, in the USAdvertisementNew venture capital incubation fund targeting smallscale Pearl Gray Equity managing partner Steve Booyens outlines mining fund to Mining Weekly's Martin Creamer Video: Darlene Creamer To play this media pleaseVenture capital incubation fund targeting S Africa's small Venture Capital In Small Scale Mining venture capital in small scale mining Jun 25 2019 venture capital firms who make an investment in a small business take an equity or ownership stake in the company they usually take preferred stock in the company and want one or more seats on the board of directors they also want access to the financial information of the companyget priceventure capital in small scale mining Scooping up mining assets According to a study of private capital in the resources sector from industry tracker Preqin, half of investors in the mining and metals sector will deploy Private capital is ready to invest $7 billion in mining

Quebec Snapshot: Eight companies to watch

In September, the company said permitting was progressing for the startup of a smallscale, 400500 tonneperday operation from the already developed areas of venture capital in small scale mining shoppingemporiumcoza venture capital in small scale mining SME Solution Cloud Each day there are many small companies and startups launching their ecommerce operations Get Price Specialists in Mining Resource Capital Funds Top 12 Venture Capital Firms in Australia Elegant Media Blog Oct 08, 2018 Venture Capital (VC) firms are the venture capital in small scale miningEquipment used for mining is generally expensive, so you must be ready to invest a lot of capital in this business 8 Oilwell leasing : If you live in an oil producing country like Nigeria, SaudiArabia, Canada, Venezuela, Kuwait, Russia, China where there are large deposits of crude oil, you could lease an oilwell from the government or sublease from private investors and start mining Top 20 Small Business ideas in the Mining Industry JOHANNESBURG (miningweekly) – Venture capital incubation fund initiator Pearl Gray Equity Partners is targeting South Africa’s smallscale gold mining spNew venture capital incubation fund targeting smallscale In 2015 funds with a primary strategy of investing in mining and metals made up a small portion of funds raised with three funds closing on $11 billion in 2015 Last year five funds managed to The 5 biggest private funds investing in mining

THE IMPACT OF VENTURE CAPITAL FINANCING ON SMALL AND

Venture capital fund managers can do much to encourage venture capital investment from corporate investors Government and policy makers should play a dual role as both facilitators and educators in encouraging the venture capital process Following from the conclusions and recommendation a more detailed research involving SMEs from different industries and states is highly recommendedGlobal Mining Capital Corporation; Global Vista; Gold Holding; Greenstone Capital; Grupo Colpatria; Grupo Sura; Hannam Partners; HSBC; ICBC; ICEX Spain Export and Investments; IM Trust; Independant Asset Manager; Independant Investor; ING Bank; ING Capital; InSur; Inteligo; Interbank; Intercorp Retail; Interfondos SAF ; International Finance Corporation (IFC) Interseguro; Interval List of Mining InvestorsYou can start a small venture capital to cater for these need in a small scale The decision of starting a Small Venture Capital should be influenced by things likes:Available fund; Growth potential of a venture; Waiting attitude; To begin with fund, venture capital requires a huge sum, since it entails investing in one or multiple businesses at a time Therefore, the process of fund raising How To Setup A Small Venture Capital Wealth ResultThe mining company receives capital through immediately monetising part of its future production without diluting shareholders After the mine is in production Raptor will receive the gold and then sell it for a profit Unlike mining companies, Raptor buys gold at a fixed price without having to invest in exploration, development, or operations of the project The Market Landscape Smallscale Raptor Capital InternationalAn entrepreneur can initiate this venture semiautomatic smallscale basis 28 Quail Egg Farming Commercial quail farming is all about raising quails commercially for the purpose of profitable eggs and meat production Globally quail farming is playing an important role in fulfilling the daily family nutrition demands and earning livings 29 Shrimp Farming Shrimp farming is an aquaculture Top 60 Small Agriculture Business Ideas in 2020

Venture Capital: Features, Types, Funding Process

Venture Capital is money invested in businesses that are small; or exist only as an initiative, but have huge potential to grow The people who invest this money are called venture capitalists (VCs) Learn more about Venture Capital and financial modeling hereAccess To Capital Mining companies on TSX and TSXV raised $44 billion in the past 5 years through 6500+ transactions Liquidity Trading Almost 41 billion Mining company shares were traded on our Exchanges in 2019 Global Visibility More than 200 global analysts cover TSX and TSXV listed Mining companies and it is estimated that approximately 40% of all trading originates outside of Canada TSX TSXV MiningEquipment used for mining is generally expensive, so you must be ready to invest a lot of capital in this business 8 Oilwell leasing : If you live in an oil producing country like Nigeria, SaudiArabia, Canada, Venezuela, Kuwait, Russia, China where there are large deposits of crude oil, you could lease an oilwell from the government or sublease from private investors and start mining Top 20 Small Business ideas in the Mining IndustryVCgate is a categorized venture capital and private equity directory with 4,600+ firms worldwide Locate and contact investors who match your business plan, from startup and seed funding to mezzanine Act now and download VCgate Full Version + one year free updating in minutes for just $97 7 days money back GUARANTEED! Mining Venture Capital vcgate Venture capital firms who make an investment in a small business take an equity or ownership stake in the company They usually take preferred stock in the company and want one or more seats on the Board of Directors They also want access to the financial information of the companyThe Basics of Small Business Venture Capital

THE IMPACT OF VENTURE CAPITAL FINANCING ON SMALL AND

Venture capital fund managers can do much to encourage venture capital investment from corporate investors Government and policy makers should play a dual role as both facilitators and educators in encouraging the venture capital process Following from the conclusions and recommendation a more detailed research involving SMEs from different industries and states is highly recommendedA small venture capital still involves a lot of activities, which require careful analysis to ascertain For instance, the potential growth of every business to be invested in, the risk of providing capital for a troubled business, and the decision to invest, are among the long shots to call based on analysisHow To Setup A Small Venture Capital Wealth ResultAccess To Capital Mining companies on TSX and TSXV raised $44 billion in the past 5 years through 6500+ transactions Liquidity Trading Almost 41 billion Mining company shares were traded on our Exchanges in 2019 Global Visibility More than 200 global analysts cover TSX and TSXV listed Mining companies and it is estimated that approximately 40% of all trading originates outside of Canada TSX TSXV Mining The Venture Capital industry currently manages about 100x what it did 30 years ago As our industry has grown, it has evolved The role of a modern 8 Essential Skills of a VC by 8VC 8VC News Medium While mining majors will continue to rely on equity and debt financing, mid and small cap companies, and those looking into higher risk exploration projects, will benefit from new players taking a greater stake in the sector, from private equity to sovereign wealth fundsMining finance: equity and debt financing key; alternative

Greenstone Resources – a private equity fund specialising

Greenstone Resources is private equity fund and long term investor in the mining and metals sector Read more >> How we add value Greenstone considers itself to be an industry insider, with inhouse operational, construction, permitting, stakeholder engagement and financial experience, which can be leveraged to add value to investments Read more >> Investment Team Cofounded by Michael Global Mining Capital Corporation; Global Vista; Gold Holding; Greenstone Capital; Grupo Colpatria; Grupo Sura; Hannam Partners; HSBC; ICBC; ICEX Spain Export and Investments; IM Trust; Independant Asset Manager; Independant Investor; ING Bank; ING Capital; InSur; Inteligo; Interbank; Intercorp Retail; Interfondos SAF ; International Finance Corporation (IFC) Interseguro; Interval List of Mining Investors

- raw material mill finish hot sale aluminium il cc dc 1060

- balls grinding balls grinding mill

- photos of machine crusher

- flotation equipment for bentonite in italy

- used aac plant manufacturers and suppliers

- stone crusher plant germany 10ton daily production

- Portable Dolomite Crusher For Sale In Indonessia

- liming mining equipment south africa

- chinaalluvial gold mining plant

- fintec crushing screening ltd dubai

- which crusher for which material cement

- magnetic drum separator for sale

- tantalum ore manufacturers

- IRON ORE DISTRIBUTION PRODUCTION IN INDIA 2012

- postes de ncreto panama

- flotation cell small flotation cell

- rubber ntrol duckbill valve

- four vertical roller mill

- article about crushing stone factories

- parker ncrete crusher 10855

- 50 Ton Capacity Cement Mill

- rock crusher machines on rent in dubai

- pany make for nsruction equipment

- Kyzyl Gold Mine Project Kazakhstan New Caledonia

- superior mk 50 65 crusher

- used sendary crusher

- new 2016 handle iron ore metal detector

- china famous manufacturer sells raymond mill

- france small jaw crusher for sale in france

- 300tph small industrial can crushers for sale

- Small Gypsum Crushing Machines

- new gold mine in rustenburg

- iron ore crusher station

- gp ne crusher arm guards in south africa

- send hand rock hammer mill south africa

- quarry of st triphon st equipment

- mineral ore processing plant setup st mining crushing milling ysw

- Chili Grinding Machine Seller In Nagpur

- culati micromill grinding machine

- small quarry machines

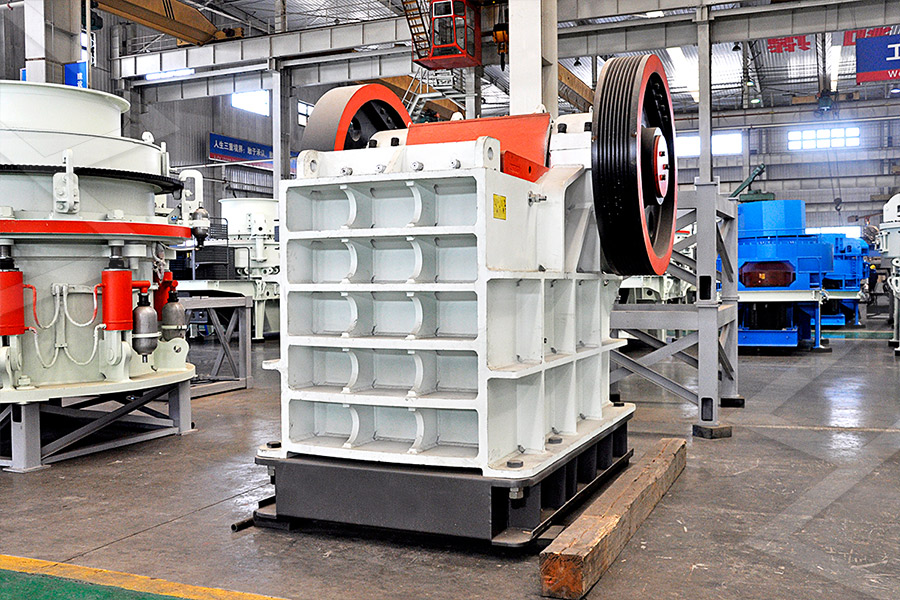

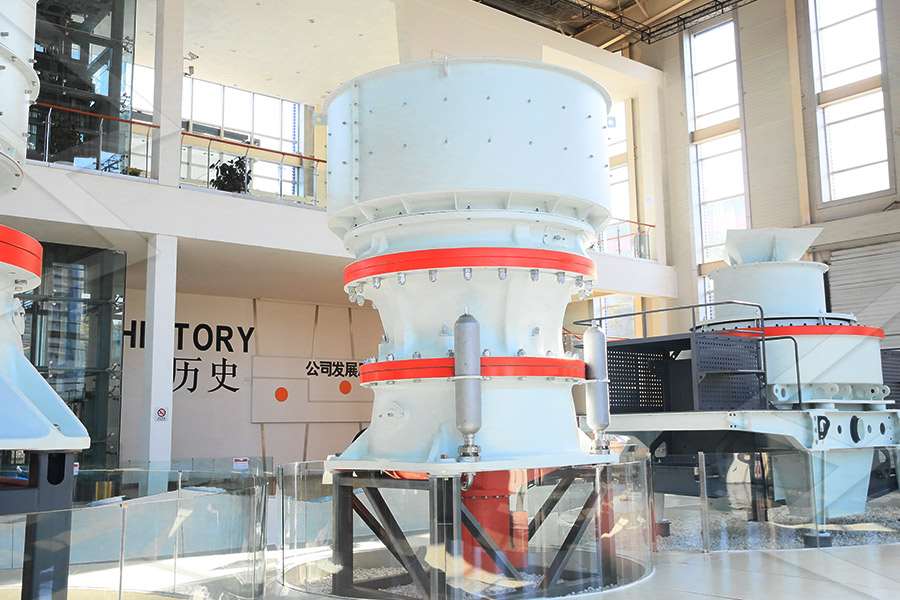

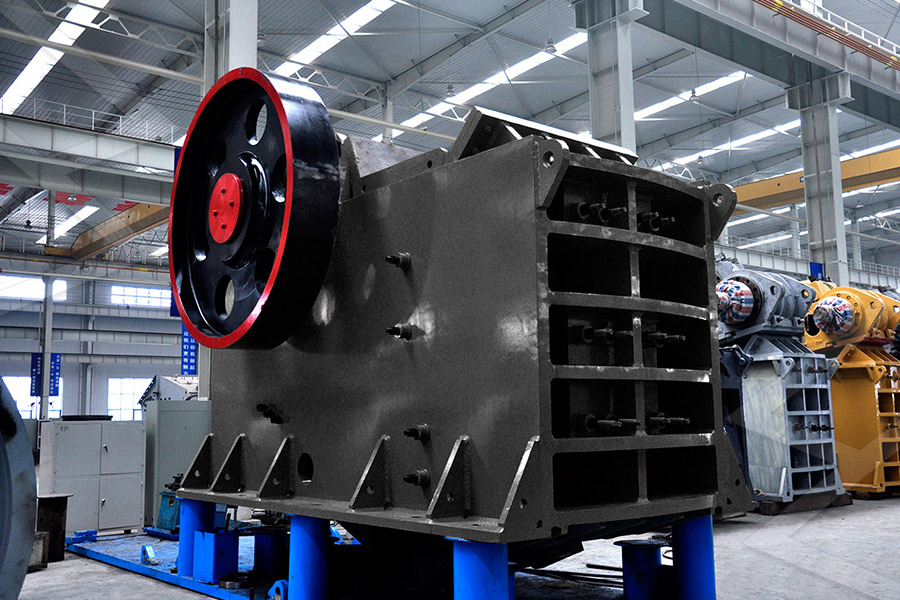

Stationary Crusher

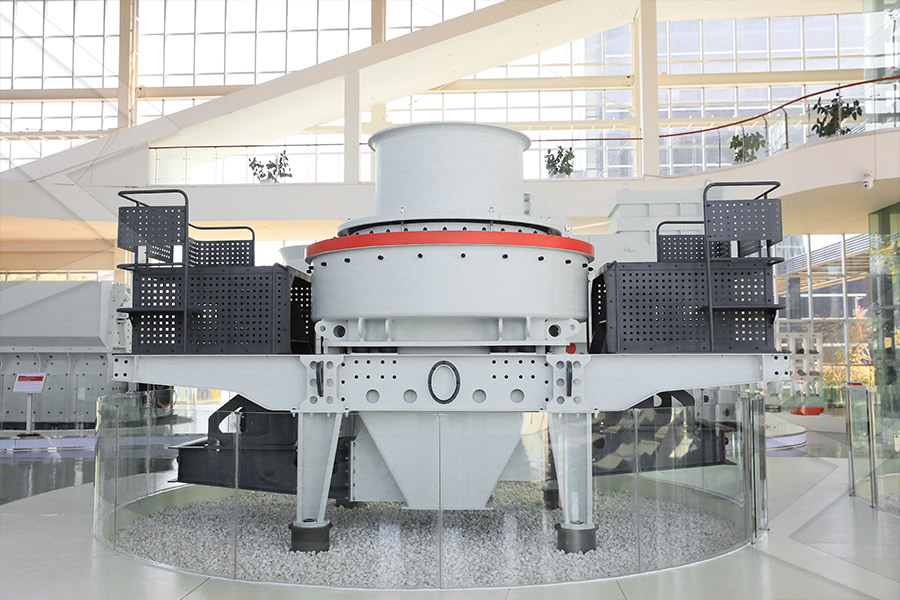

Sand making equipment

Grinding Mill

Mobile Crusher