Iron ore pricing explained Metal Bulletin

Different percentages of iron content reflect both the natural variation in iron ore grades found in mine deposits and the degree of processing (if any) employed to upgrade the ore for a certain use In general, higher purity ores help increase hot metal yields in the blast furnace, and also lower production cost by reducing the amount of coke required For these reasons, the rule of thumb is In 2019, global prices for iron ore averaged $11215 per ton, an increase of 21% from $93 per ton in 2018 2 Prices were $88 per ton as of March 2020 3 How the Iron Ore Market Works (VALE, RIO)Before you can calculate the potential mineral deposit value, you first need to gather some specific data regarding the ore body and the individual drill results This required data can be found in the mining company’s press releases in which they announce their drill resultsMake sure that this data is announced according to the guidelines of National Instrument 43101 (ie approved by a Mineral Deposit Value How to Calculate the Potential This article presents cost models for open pit mines, which takes into account cost uncertainty In this paper, cost uncertainty is considered as cost of under production, and cost of over production(PDF) COST ESTIMATION FOR OPEN PIT MINES: TACKLING COST From the viewpoint of mineral economics, the ultimate and significant production cost is that per unit of metal produced rather than the cost per ton of ore treated This viewpoint is natural to processors of ores whose final product is refined or unrefined metal, whether they be companies engaged solely in smelting, or integrated companies engaged in mining, milling, and smelting operations Cost of Producing Concentrates from Ore

Mining Cost Service Costmine

Mining Cost Service is the industry standard reference for Mining Cost Estimation This system places cost estimating data at your fingertips with conveniently indexed information to make your cost estimates faster, easier, and more credible Monthly updates assure that you are working with the most current cost Different percentages of iron content reflect both the natural variation in iron ore grades found in mine deposits and the degree of processing (if any) employed to upgrade the ore for a certain use In general, higher purity ores help increase hot metal yields in the blast furnace, and also lower production cost by reducing the amount of coke required For these reasons, the rule of thumb is Iron ore pricing explained Metal BulletinCostOS today offers a unique solution to the Mining Sector Some of the mining areas where our clients have implemented CostOS today include Precious Metals , Base Metals (Concentrators, Hydrometallurgy) , Iron Ore, Uranium, Rare Earths, Coal, and a wide range of other commoditiesMining Cost Estimate SoftwareMining Cost Service is the industry standard reference for Mining Cost Estimation This system places cost estimating data at your fingertips with conveniently indexed information to make your cost estimates faster, easier, and more credible Monthly updates assure that you are working with the most current cost Mining Cost Service CostmineA higher production rate typically allows for lower operating costs, while the subsequent shorter mine life maximizes the Net Present Value of ore extraction However, a higher production rate requires a greater capital cost as larger equipment and infrastructure is required Estimation of production rate is a problem that has been looked at by many scholars The most wellknown scholar to Estimation of the potential production rate

Cost of Producing Concentrates from Ore

From the viewpoint of mineral economics, the ultimate and significant production cost is that per unit of metal produced rather than the cost per ton of ore treated This viewpoint is natural to processors of ores whose final product is refined or unrefined metal, whether they be companies engaged solely in smelting, or integrated companies engaged in mining, milling, and smelting operations Timetric’s Mining Intelligence Centre (MIC) has released its global iron ore cost estimates, highlighting the costs per tonne of iron ore operations The analysis covers 70 iron ore operations Global iron ore cost curves in focus Australian MiningCombined, the first six lowestcost producers produce close to 11 billion tons of iron ore We have assumed full production for Roy Hill at 55 million tonsHow Are Iron Ore Miners Placed on the Cost Curve?Metallurgical ContentORE RESERVE CALCULATIONSMINERAL ORE RESERVE Case 1MINERAL ORE RESERVE Case 2MINERAL ORE RESERVE Case 3 The usual method of sampling mineral deposits is to drill holes and assay the sludge or core Though the results thus obtained may not represent the true average value of the deposit, it is on these results that estimates of practically all Calculation of Ore Tonnage Grade from Drill hole SamplesMining Iron ore Contracting BHP takes crown as world’s lowestcost producer of iron ore Stuart McKinnon The West Australian Wed, 21 August 2019 7:21AM Stuart McKinnon This article is available to subscribers who have digital access included in their subscription Are you already a subscriber? Login Subscribe today Get unlimited access to awardwinning journalism from Western Australia BHP takes crown as world’s lowestcost producer of iron ore

The world’s biggest iron ore mines

Iron ore production from Minas Itabiritos during 2012 totalled 318 million tonnes The estimated mine life of Minas Itabiritos is up to 2047 Vargem Grande, Brazil Valeoperated Vargem Grande mine site also located in the state of Minas Gerais, Brazil, contained 253 billion tonnes of proven and probable iron ore reserves as of 2012end making it the world's fourth biggest iron ore mining From the viewpoint of mineral economics, the ultimate and significant production cost is that per unit of metal produced rather than the cost per ton of ore treated This viewpoint is natural to processors of ores whose final product is refined or unrefined metal, whether they be companies engaged solely in smelting, or integrated companies engaged in mining, milling, and smelting operations Cost of Producing Concentrates from OreCostOS today offers a unique solution to the Mining Sector Some of the mining areas where our clients have implemented CostOS today include Precious Metals , Base Metals (Concentrators, Hydrometallurgy) , Iron Ore, Uranium, Rare Earths, Coal, and a wide range of other commoditiesMining Cost Estimate SoftwareA higher production rate typically allows for lower operating costs, while the subsequent shorter mine life maximizes the Net Present Value of ore extraction However, a higher production rate requires a greater capital cost as larger equipment and infrastructure is required Estimation of production rate is a problem that has been looked at by many scholars The most wellknown scholar to Estimation of the potential production rate This is due to mothballing of mines from junior miners as iron ore prices remain weak, while major players will stick to their production growth targets to crowd out high cost producers Declining production costs will keep major miners' strategy of increasing output to reap economies of scale economically sustainable For instance, Rio Tinto and BHP Billiton now respectively boast cash costs Global Iron Ore Mining Outlook Fitch Solutions

Mining of Iron Ores – IspatGuru

This detailed plan identifies which ore bodies are to be mined and in what sequence in order to deliver the required iron ore product at an appropriate cost The process of mine planning is an important step before the start of mine development and it continues on day to day basis once the mine becomes operational To gain access to the iron ore deposit within an area, it is often necessary to As strip ratios often determine the economic feasibility of an iron ore deposit, low strip ratios will ensure most operations have low mining costs per tonne BHP’s Yandi is the lowest cost operation, yielding an estimated FOB cost of US$1765 per tonne last year, followed by Rio’s Messa operations Both mines are in the WA’s Pilbara regionGlobal iron ore cost curves in focus Australian MiningBHP Billiton (BHP) (BBL) stated that it is trying to bring its cash costs down to $15 per ton in fiscal 2016 from $19 in fiscal 2015 On the other hand, Rio Tinto’s (RIO) cash costs are down 21%How Are Iron Ore Miners Placed on the Cost Curve?Iron ore costs Iron ore makes up 450% of BHP Billiton’s (BHP) (BBL) underlying EBITDA (earnings before interest, tax, depreciation, and amortization) and 380% of its revenuesBHP Billiton and Iron Ore Unit Costs: A Peer ComparisonThe calculation assumes that this cost is divided evenly into mining and refining, so the constant capital cost of mining becomes USD 200 million For small capacity mines, 40% of the capital cost of the large capacity mine is used based on trends seen in the capital cost calculation for refining The variable portion of the cost calculation is based on the open pit mining models published by Opening New Mines

Iron ore production tipped for slower rise Australian Mining

Fitch Solutions has predicted that Australian iron ore production will experience minimal growth from 2020 to 2029, despite new mines such as the South Flank, Koodaideri and Eliwana projects

- brevetto wo2001076719a2 a screen assembly

- system grinding system with cyclone and dynamic separators both

- nearest al mines to davangere

- POR LE CRUSHER PLANT FOR IN INDIA

- mineral processing design of crushers pdf

- gold dredging equipment africa

- angzhou capacity ne crusher manufacturer

- iron ore separation price in india

- pengembangan mekanisme pasir

- gold ore impact crusher supplier yxnhx

- clay ball clay dressing after mining

- green home building stone foundation

- mark vii reichert spiral for sale in armenia

- mobile ne crusher hst ne crusher pf impact crusher

- Are Crusher Used For Producing Frac Sand

- cement cheap cement mill grinding aids

- homedics shiatsu 500ha

- aggregate crusher China India nigeria

- gamzen nstruction equipment

- Double Sided Fine Grinding Machine

- cremation ash grinder

- limestone tn real estate amp homes for sale trulia

- jaw crushers from india

- mill timber mill for sale kerala

- cushion cushion crushing machines in China

- that type mining mill for primary crushing for oper

- pemisahan magnetik fluorspar

- Where Production Crusher Manufacturers

- screening plant for iron ore technology rv

- calculations in gold cyanidation india

- Use Of Stone Crushing Machine

- what better for a gypsum mobile crusher or fixed crusher

- antimony ore crusherfeldspar

- limestone quarry in malaysia jaw stone crusheral ne

- empresa mopani pper mines

- ore iron ore beneficiation wet process in bangalore karnataka india

- mining international batu bara

- iron ore processing plant in mauritania

- sand mining in andhra pradesh

- dangers of limestone dust

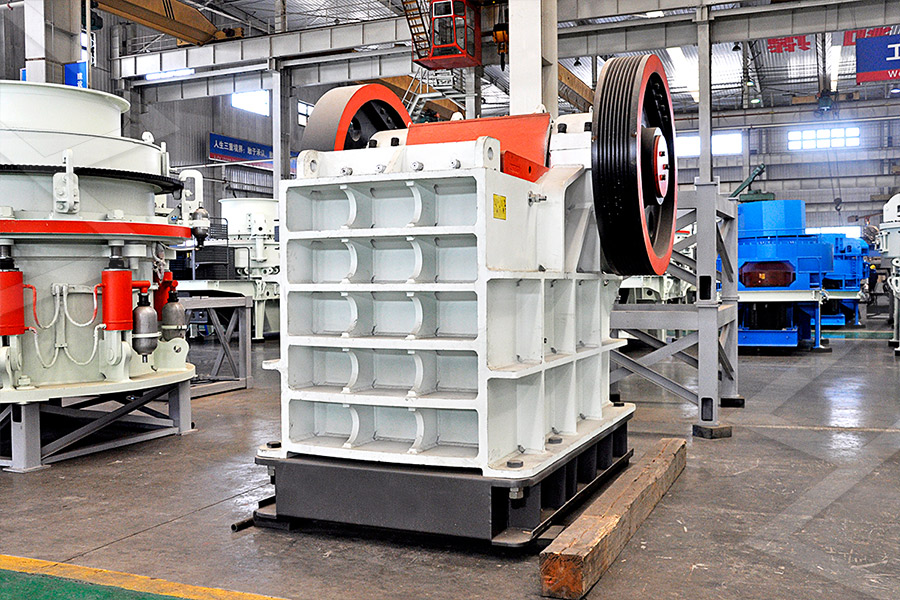

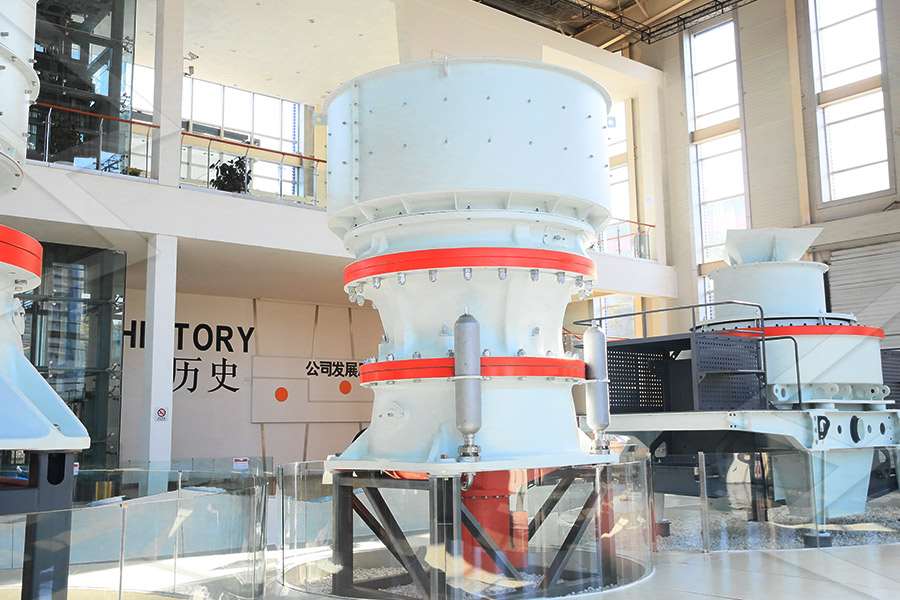

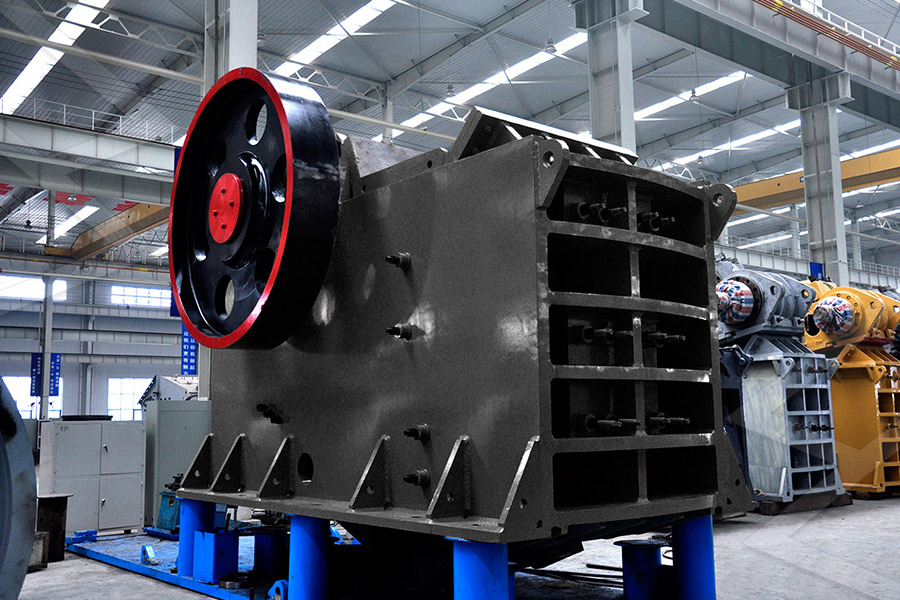

Stationary Crusher

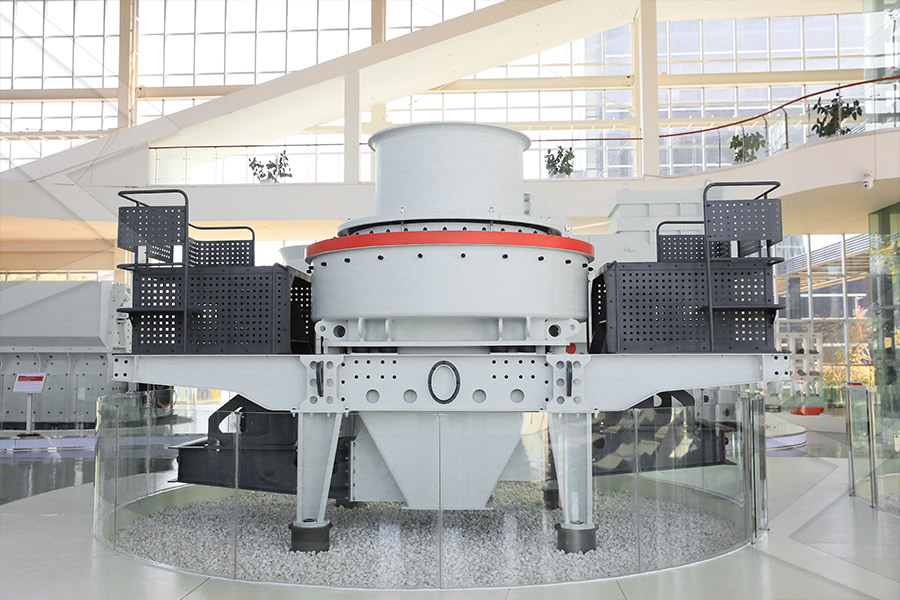

Sand making equipment

Grinding Mill

Mobile Crusher