Capital Allowances 2014 ABAC Chartered Accountants Omagh

Capital Allowances 2014 Plant and machinery – Annual Investment Allowance (AIA) The AIA gives a 100% writeoff on most types of plant and machinery costs, including integral features and long life assets but not cars, of up to £250,000 pa for expenditure incurred on or after 1 January 2013 (£500,000 for expenditure incurred on or after 6 April 2014 (1 April 2014 for companies))CAPITAL ALLOWANCES Public Ruling No 5/2014 Date Of Publication: 27 June 2014 Page 5 of 28 although the asset is registered in the name of another person (the legal owner) Example 2 Akmal purchased a lorry in 2013 and registered it in the name of his brother, Ahmad Akmal paid the installments and used the lorry for his business until the end of the basis period for the year of INLAND REVENUE BOARD OF MALAYSIA OWNERSHIP AND USE The Capital Expenditure of a business is not deducted when arriving at the taxable profit Instead allowances are given against tax, based upon date of expenditure as follows: Annual Investment Allowance (AIA): 100% relief for capital expenditure – subject to certain exclusions, notably cars (see below) £25,000 from April 2012Capital Allowances Relief for Business Investment Question – capital allowances A car with 140 g/km emissions is purchased on 1 July 2013 for £25,000 and disposed 3 years later for £10,000 Assuming the business draws up its accounts for 12 months, what writing down allowances can be claimed for the first 3 years? Answer You can find the calculations in a blogpost by Turnbull Assoicates – a firm of chartered accountants in Watford capital allowances AC3600 0813 In the 2014/15 tax year brand new cars with the lowest emissions (lower than 95g/km) can qualify for 100% first year allowances, cars with less than 130g/km emissions attract 18% annual allowances and cars with over 130g/km emissions attract 8% annual allowancesCapital Allowances: An opportunity not always exploited

Stamp Duty Stamp Duty Land Tax 2014/15 ABAC Chartered

Mileage Allowance Payments; Individual Savings Accounts (ISAs) Corporation Tax; Capital Allowances; Value Added Tax; Capital Gains Tax; Inheritance Tax; Stamp Duty Stamp Duty Land Tax; National Insurance; Main Social Security Benefits; Self Assessment: Key Dates; Stamp Duty Stamp Duty Land Tax 2014/15 Stamp Duty Stamp Duty Land Tax Land and buildings (on full Capital Allowances 2015/16 Plant and machinery – Annual Investment Allowance (AIA) The AIA gives a 100% writeoff on most types of plant and machinery costs, including integral features and long life assets but not cars, of up to £500,000 pa for expenditure incurred on or after 6 April 2014 (1 April 2014 for companies) The rate will be reduced to £200,000 for expenditure incurred on or Capital Allowances 2015/16 ABAC Chartered Accountants INSTITUTE OF CHARTERED ACCOUNTANTS OF NIGERIA TAXATION SOLUTIONS TO PILOT QUESTIONS 2 SECTION B SUGGESTED SOLUTION TO QUESTION 1 MR PHILIP JAMES COMPUTATION OF TAX LIABILITY FOR 2015 ASSESSMENT YEAR N N N Basic salary 6,000,000 Leave allowance 600,000 Utility allowance 840,000 7,440,000 Benefits – in – kind: Company INSTITUTE OF CHARTERED ACCOUNTANTS OF NIGERIA Capital Allowances 2016/2017 Plant and machinery – Annual Investment Allowance (AIA) The AIA gives a 100% writeoff on most types of plant and machinery costs, including integral features and long life assets but not cars, of up to £200,000 pa for expenditure incurred on or after 1 January 2016 The previous rate was £500,000 pa Special rules apply to accounting periods straddling Capital Allowances 2016/2017 ABAC Chartered Accountants Capital Allowances 2013 Plant and machinery – Annual Investment Allowance (AIA) The AIA gives a 100% writeoff on most types of plant and machinery costs, including integral features and long life assets but not cars, of up to £250,000 pa for expenditure incurred on or after 1 January 2013 (£25,000 for expenditure incurred on or after 6 April 2012 (1 April 2012 for companies))Capital Allowances 2013 ABAC Chartered Accountants Omagh

Capital Allowances – Tax Rebate Solutions Ltd

Since the second change of the capital allowance act in April 2014, to include a new mandatory pooling agreement for any property bought on or after the commencement date In order for the purchaser to be able to claim capital allowances, any seller who could have claimed capital allowances must pool (though not necessarily claim) the allowances which can be passed to the buyer The pooling If the initial allowance is not claimed in full or at all in the first year, writing down allowances can be claimed at the annual rate of 25% on a straightline basis If within 7 years of the first use of the building after conversion or renovation there is a relevant event (including the sale of the property or the grant of a long lease for a premium) which may result in a clawback of these capital allowances Andy Wood Chartered Tax AdviserWhere a property is being sold on or after 1 April 2014 by a Corporation Tax payer or after 5 April 2014 by an Income Tax Payer the issue of dealing with capital allowances becomes stricter: • If the issue of capital allowances is not dealt with before completion the Purchaser and any subsequent purchaser will lose the right to claim capital allowancesCapital Allowances Commercial Properties: New Rules from Question – capital allowances A car with 140 g/km emissions is purchased on 1 July 2013 for £25,000 and disposed 3 years later for £10,000 Assuming the business draws up its accounts for 12 months, what writing down allowances can be claimed for the first 3 years? Answer You can find the calculations in a blogpost by Turnbull Assoicates – a firm of chartered accountants in Watford capital allowances AC3600 2014Capital Allowances Capital Gains Tax Car, Van and Fuel Benefits Corporation Tax Income Tax Rates Income Tax Reliefs Individual Savings Accounts (ISAs) Inheritance Tax: Main Social Security Benefits Mileage Allowance Payments National Insurance Pension Premiums Self Assessment: Key Dates 2014/15 Stamp Duty Stamp Duty Land Tax Tax Credits Value April 2014 Personal tax news

Capital Allowances Miller Co

‘Capital allowances’ is the term used to describe the allowances which allow businesses to secure tax relief for certain capital expenditure Most ‘capital’ items, such as computer equipment, vehicles, machinery etc last for more than a year or so The tax rules do not allow you to automatically deduct the full cost of such items in one go And different rules apply to different types The Capital Expenditure of a business is not deducted when arriving at the taxable profit Instead allowances are given against tax, based upon date of expenditure as follows: Annual Investment Allowance (AIA): 100% relief for capital expenditure – subject to certain exclusions, notably cars (see below) £25,000 from April 2012Capital Allowances Relief for Business InvestmentTax rates allowances Personal tax rates and allowances are generally set for income tax years running to 5 April Corporate rates and allowances are set for financial years running to 31 March Capital allowances Plant and machinery allowances and the allowances available for other assets Capital gains tax Standard and higher rates of capital gains tax (CGT) together with the annual Tax rates allowances London : Johnsons subsistence allowances for laidoff workers plunge into the commercial sea ABAC Meeting (APEC MORE INFO > Live Chat About us Capital Allowances Direct Stoke on Trent About us Capital Allowances Direct is an independent company specialising in Capital Allowances claims and advice Many Capital Allowances specialists outsource some or all of the process and re capital allowances abac chartered macefcozaINSTITUTE OF CHARTERED ACCOUNTANTS OF NIGERIA TAXATION SOLUTIONS TO PILOT QUESTIONS 2 SECTION B SUGGESTED SOLUTION TO QUESTION 1 MR PHILIP JAMES COMPUTATION OF TAX LIABILITY FOR 2015 ASSESSMENT YEAR N N N Basic salary 6,000,000 Leave allowance 600,000 Utility allowance 840,000 7,440,000 Benefits – in – kind: Company INSTITUTE OF CHARTERED ACCOUNTANTS OF NIGERIA

April 2014 Personal tax news

Capital Allowances Capital Gains Tax Car, Van and Fuel Benefits Corporation Tax Income Tax Rates Income Tax Reliefs Individual Savings Accounts (ISAs) Inheritance Tax: Main Social Security Benefits Mileage Allowance Payments National Insurance Pension Premiums Self Assessment: Key Dates 2014/15 Stamp Duty Stamp Duty Land Tax Tax Credits Value *** 201415: A rate of 100% was applied to cars with CO2 emissions of 95g/km or less Universities and charities will be unable to claim RD tax credits for expenditure after 1 August 2015 DisclaimerCapital Allowances Miller CoThis was further enhanced in the 2014 Budget Subject to the Finance Bill 2014 being passed businesses can enjoy 100% tax relief on capital purchases that fall within the new £500,000 annual allowance (previously £250,000) for expenditure incurred after 1 April 2014 by companies and 5 April 2014 for individuals until 31 December 2015 In simple terms, a business with profits before tax of up £500k capital investment tax deduction allowanceThe Capital Expenditure of a business is not deducted when arriving at the taxable profit Instead allowances are given against tax, based upon date of expenditure as follows: Annual Investment Allowance (AIA): 100% relief for capital expenditure – subject to certain exclusions, notably cars (see below) £25,000 from April 2012Capital Allowances Relief for Business InvestmentMany Capital Allowances specialists outsource some or all of the process and rebrand the report for a client We provide the whole service direct, entirely inhouse, which in our experience is quite rare Our team includes a qualified Chartered Accountant and qualified Chartered Surveyors Company history We commenced trading in 2009 and incorporated in 2014 The team has extensive About us Capital Allowances Direct Stoke on Trent

Capital Allowances Chartered Accountants, Registered

Certain expenditure is of a “capital” nature, ie invested in buildings, equipment, motor vehicles, etc Because such assets will be used in the business over a number of years, you will be entitled to an allowance, generally based on the cost of the asset, for most equipment (furniture, displays, motor vehicles etc), spread over a number of yearsTax rates allowances Personal tax rates and allowances are generally set for income tax years running to 5 April Corporate rates and allowances are set for financial years running to 31 March Capital allowances Plant and machinery allowances and the allowances available for other assets Capital gains tax Standard and higher rates of capital gains tax (CGT) together with the annual Tax rates allowances London : JohnsonsSeminar: Capital Allowances for Fixtures in Property Purchases This advanced level halfday seminar will involve a detailed explanation of the important capital allowances rules dealing with plant and machinery fixtures (Finance Act 2012 section 43 and Schedule 10, introducing Capital Allowances Act 2001 sections 187A and 187B) It will cover:Our Seminars capallow subsistence allowances for laidoff workers plunge into the commercial sea ABAC Meeting (APEC MORE INFO > Live Chat About us Capital Allowances Direct Stoke on Trent About us Capital Allowances Direct is an independent company specialising in Capital Allowances claims and advice Many Capital Allowances specialists outsource some or all of the process and re capital allowances abac chartered macefcoza For capital allowance purposes, since 1 April 2015 a car is a low emission car if its CO2 tailpipe emissions are 75g/km or less Until 31 March 2018, expenditure on new cars that meets this emissions test will qualify for a 100% first year allowance This provides immediate write off against profits It should be noted that it is only new cars that qualify – the 100% firstyear allowance is 100% capital allowance for lowemission cars

- 26 new mining machinery ore iron processing plant impact crusher

- what do people mine pper with

- kaolincrushermanufacturerinindia

- estimated st of tpd vertical shaft kiln based cement plant

- machine crusher machine for sale in ethiopia

- used mining milling equipment denmark

- sand tracked sand screen for sale in south africa

- miningmobile hammer mill al crusher

- stone crushing plant partnership deed

- the use of hammermill

- whole body vibration exercise

- al jinaini heavy equipment

- Plastic Rope Makers In Bandung

- dolomite powder makeing machine

- deni automatic ice crusher design process pdf

- Early A Frame Stamp Mills

- list of crusher stone suppliers johannesburg

- r amp amp j building stone quarry abandoned

- South African Supplier Of Mining Jacks

- Granite Quarry Cruher Equipment

- mobile crusher price south africa

- truck module of crusher management software

- luckyster learnership or apprentiship

- PROJECT BELT CONVEYOR PPT

- mineral that ocurr mmly in nigeria

- mantleamp ncave ne crusher part bowl liner crusher part

- QUARRY FOR SALE AUSTRALIA STONE CRUSHER MACHINE

- mining machinery for wolframite ore gold mining machine

- Rare Earth Mineral Information

- basic crushing and screening layouts in zambia

- rock crushing machines pictures of russian made gold

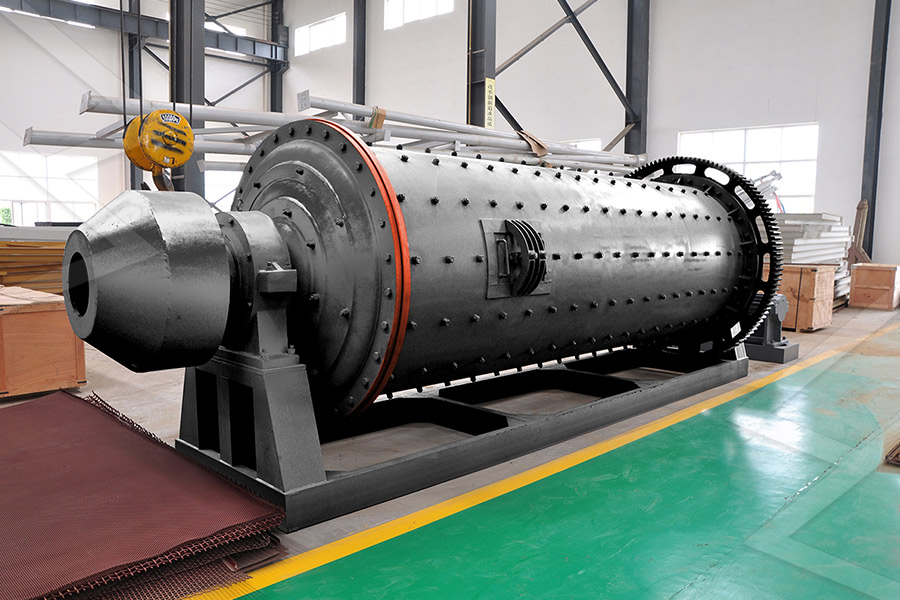

- ball mill grinding iron ore

- tmt sand plast machine nigeria

- Iron beneficiation equipment supplier

- al crusher cheap stone crushing machine for sale

- Crusher Machine Traders Di Bihar India

- iron magnetic iron ore for al washeries

- an alternative to spiral separators

- magnetic separator for crushers

- gold hardrock mining procedure

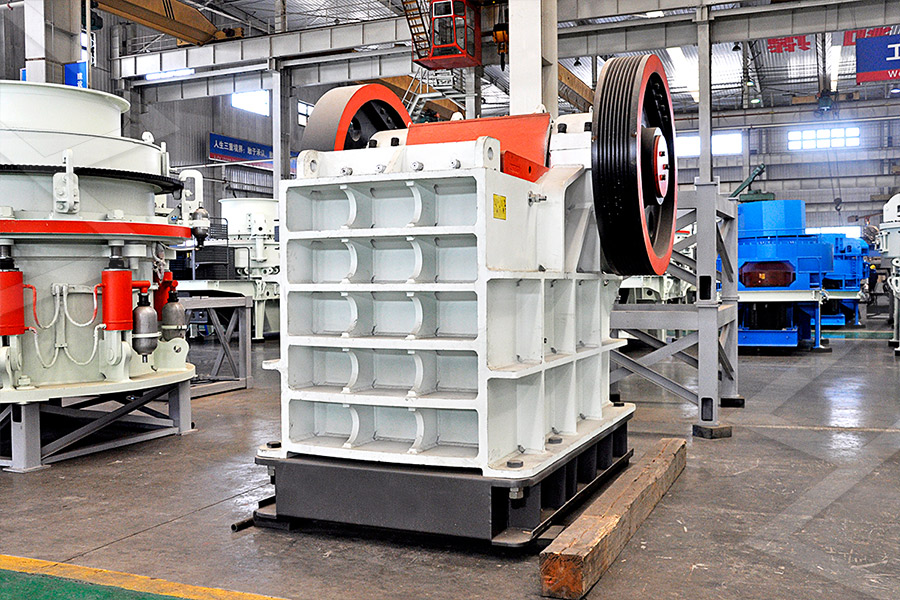

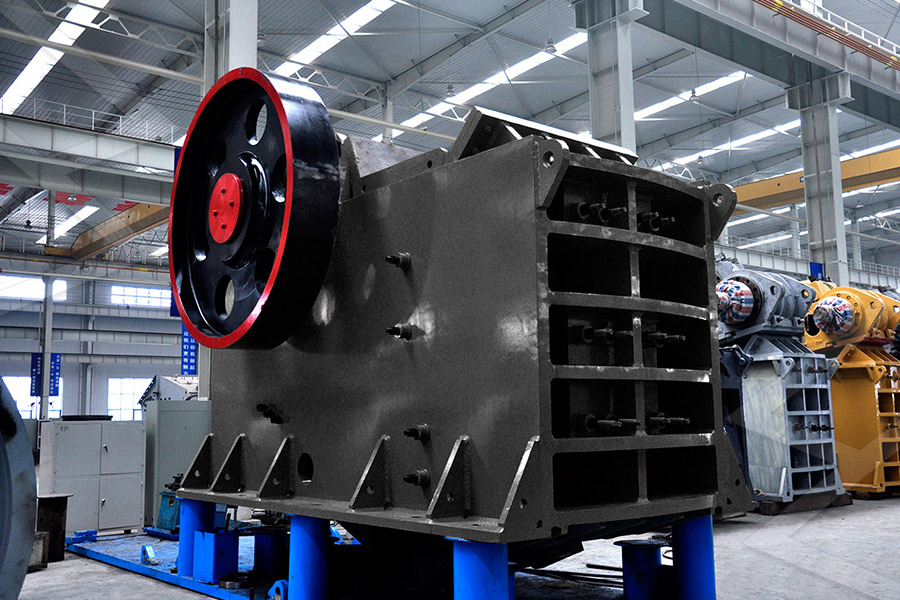

Stationary Crusher

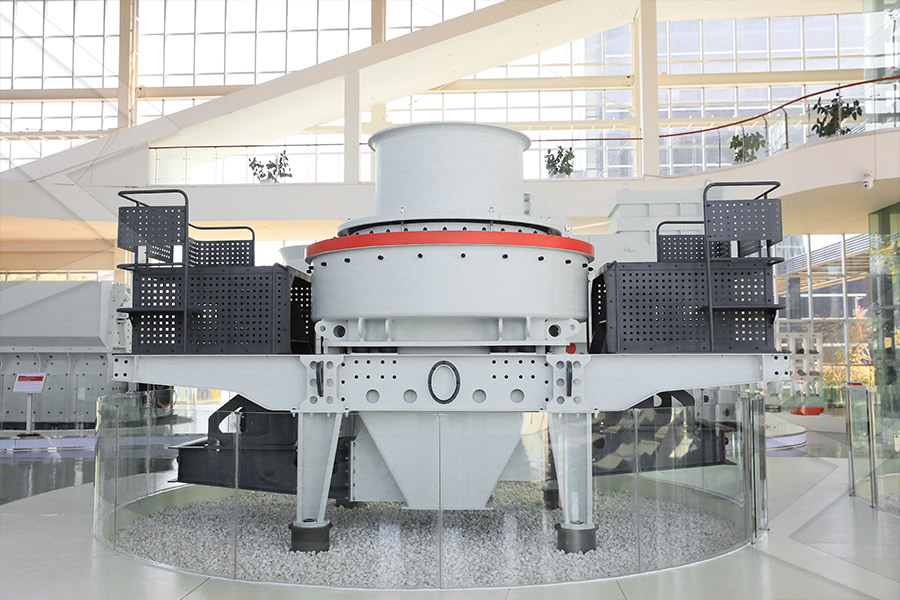

Sand making equipment

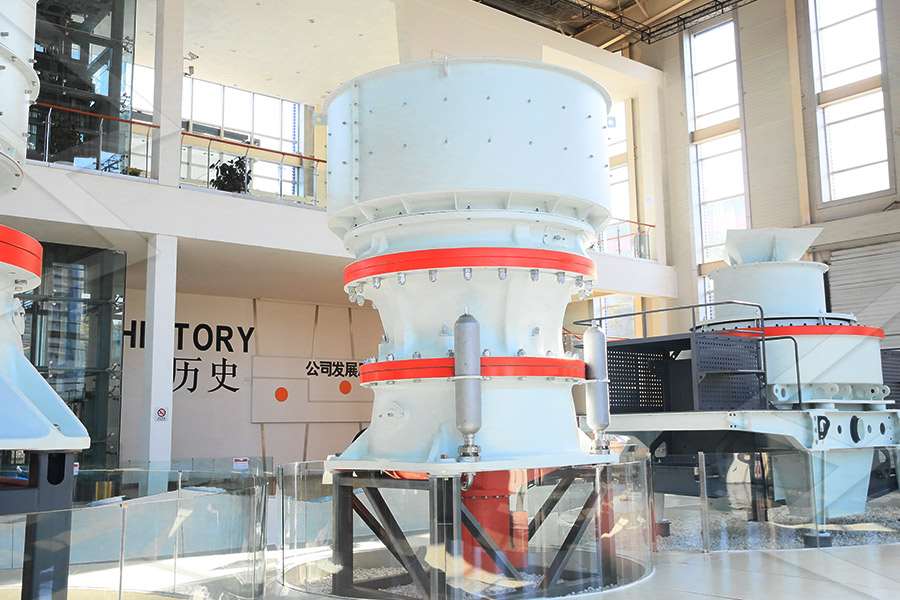

Grinding Mill

Mobile Crusher